Latest Insights on Solar Industries Share Price

Importance of Solar Industries Share Price

In the rapidly growing sector of renewable energy, the performance of companies like Solar Industries India Ltd (SIIL) is crucial for investors and industry analysts alike. Solar Industries, a leading manufacturer of explosives and other related products, has been stepping up its game as the global shift towards sustainable energy gains momentum. The company’s share price reflects its financial health, investor confidence, and market dynamics, making it an essential topic for anyone involved in the stock market or the energy sector.

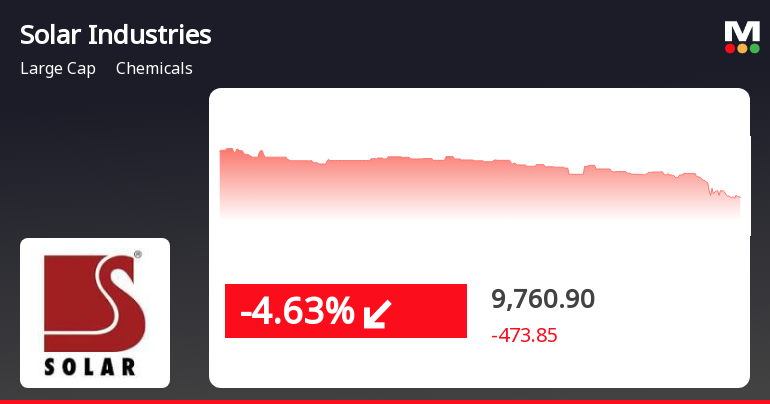

Current Market Performance

As of October 2023, Solar Industries’ share price has shown significant volatility in the stock market. Recent reports indicate that the share price has fluctuated between INR 2,800 to INR 3,100 over the past month. Factors influencing this fluctuation include quarterly earnings reports, market demand for their products, and broader economic conditions. For instance, the company reported a year-on-year revenue increase of 15% in its last quarterly results, owing largely to rising demand for their explosives in both mining and construction sectors.

Key Influencers

Several factors are influencing the share price of Solar Industries:

- Revenue Growth: With the government’s push towards infrastructure improvement and mining activities, Solar Industries has positioned itself to benefit from expanded projects across India.

- Global Supply Chain Dynamics: The ongoing challenges in the global supply chain have affected raw material costs, which in turn impacts the pricing structure for companies manufacturing industrial products.

- Investor Sentiment: Analysts suggest that sustained positive news from the company regarding contracts and expansions has bolstered investor confidence resulting in increased buying activity.

Future Projections

Looking ahead, the outlook for Solar Industries’ share price is cautiously optimistic. If current growth trends continue and there are no major disruptions in operations or supply chains, analysts believe the share price could see an upward trend. However, potential investors should remain vigilant about market volatility and economic conditions that may impact the overall industry. Diversification in investment and keeping abreast of market news will be crucial for success in this area.

Conclusion

The performance of Solar Industries share price is indicative of broader market trends in renewable energy and industrial production. As the company continues to adapt to market dynamics, those interested in its shares should consider long-term growth strategies over short-term volatility. Staying informed about industry developments and maintaining a balanced portfolio can help navigate the potential uncertainties in this fast-evolving market.