Latest Insights on Solar Industries Share Price

Introduction

As the focus on renewable energy accelerates, Solar Industries India Ltd. stands at the forefront of the industry. The company’s financial performance is closely watched by investors, and its share price movements can provide insights into the broader market trends related to solar energy. Understanding the current status of Solar Industries share price is crucial for investors and stakeholders in making informed decisions.

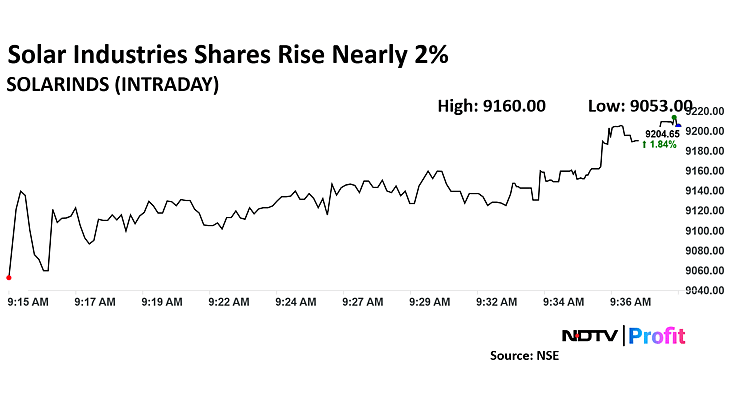

Current Share Price Trend

As of October 2023, Solar Industries India Ltd. has shown significant fluctuations in its share price. Recent reports indicate a share price hovering around INR 2,800, reflecting a 5% increase over the past month. This rise can be attributed to enhanced market interest following the government’s initiatives aimed at boosting renewable energy production. Analysts suggest that the consolidation in the solar sector and favorable regulations have prompted a positive market sentiment.

Factors Influencing Share Price

Several key factors have influenced the share price of Solar Industries:

- Government Policies: The Indian government has been actively promoting solar energy through various schemes and incentives, which has contributed to the growth of the sector.

- Market Demand: With increasing awareness about climate change, the demand for solar products is on the rise, thus enhancing the revenue potential for Solar Industries.

- Financial Performance: The company’s recent quarterly results demonstrated a robust increase in profits, further expanding investor confidence.

What Analysts Are Saying

Market analysts remain optimistic about Solar Industries’ potential in the upcoming quarters. Many predict that with a projected compound annual growth rate (CAGR) of around 20% for the solar sector, the share price could see significant growth. Industry experts recommend monitoring the performance closely, as the company is expected to benefit from new projects and collaborations within the renewable energy sector. However, they caution that market volatility and global economic conditions could impact stock performance.

Conclusion

The current trends surrounding Solar Industries share price reflect the growing investment in renewable energy solutions in India. As the company continues to capitalize on market opportunities and governmental support, investors are encouraged to stay informed about future developments. With an optimistic outlook for the solar sector, Solar Industries presents an intriguing investment opportunity, albeit with inherent risks associated with stock market fluctuations.