Latest Insights on PVR Share Price

Introduction

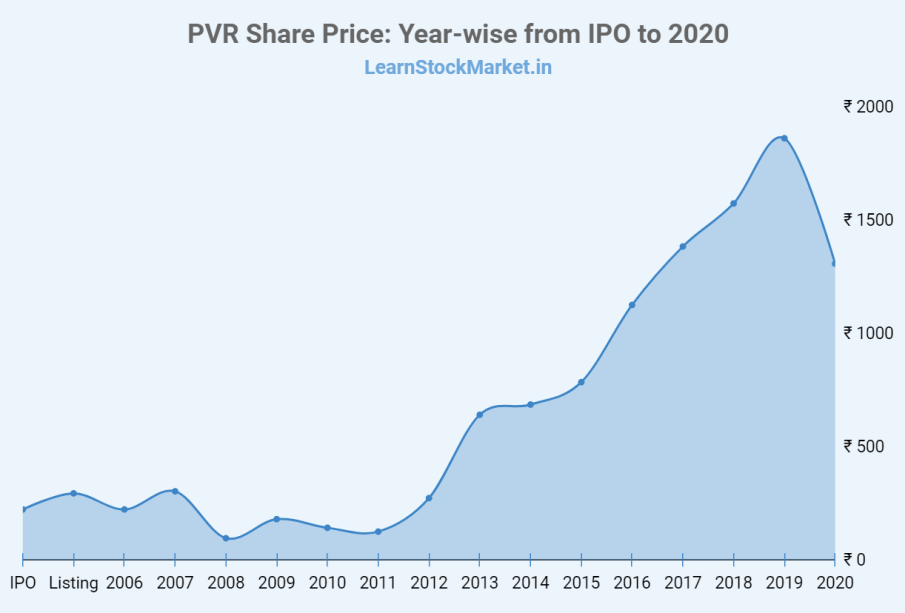

The share price of PVR Ltd., one of India’s premier multiplex operators, has garnered significant attention from investors and analysts in recent times. As the entertainment industry rebounds post-pandemic, understanding the fluctuations in PVR’s share price is crucial for stakeholders looking to make informed investment decisions. Recently, with an uptick in cinema attendance and innovative strategies for growth, PVR has positioned itself as a key player in the entertainment sector.

Current Trends in PVR Share Price

As of October 2023, PVR’s share price saw considerable volatility, reflecting broader market trends and sector-specific developments. According to financial reports, PVR shares traded at ₹1,790 per share, marking a 5% increase from the previous month. This rise follows positive quarterly earnings, which highlighted a robust recovery in footfalls and ticket sales, particularly during festive seasons.

Factors Influencing PVR Share Price

Several factors influence PVR’s share price, including:

- Box Office Performance: The success of major film releases directly impacts PVR’s revenue. Recent blockbuster hits have spurred increased viewership, positively influencing investor sentiment.

- Expansion Plans: PVR has been steadily expanding its footprint across India. The announcement of new multiplexes in tier-2 and tier-3 cities is seen as a long-term growth strategy, potentially boosting future revenues.

- Consumer Trends: Shifting consumer preferences towards premium cinema experiences, such as dine-in theatres and enhanced viewing technologies, have further positioned PVR favorably in the market.

Market Response and Predictions

Market analysts remain optimistic about the future trajectory of PVR’s share price. With analysts projecting a price target of around ₹2,000 within the next quarter, investors are encouraged to remain abreast of market developments and company announcements. The potential for inflating ticket prices amidst rising operational costs also poses both opportunities and risks for the company.

Conclusion

PVR’s share price reflects its proactive approach to adapting to changing consumer behaviors and recovering from the impacts of the COVID-19 pandemic. For potential investors, understanding these dynamics is critical for navigating the share market effectively. As PVR continues to innovate and expand, it is likely to remain a focal point within the entertainment sector, making it essential for investors to keep a close eye on its share price movements and strategies moving forward.