Latest Insights on Concor Share Price Performance

Introduction

The share price of Container Corporation of India Limited (Concor) has become a focal point for investors and market analysts alike. As a major player in the logistics and transportation sector, Concor’s performance is crucial for understanding the larger market trends in India’s economic recovery post-pandemic. With its strategic role in freight movement, the fluctuations in Concor’s share price can reveal much about the infrastructure and trade dynamics in the country.

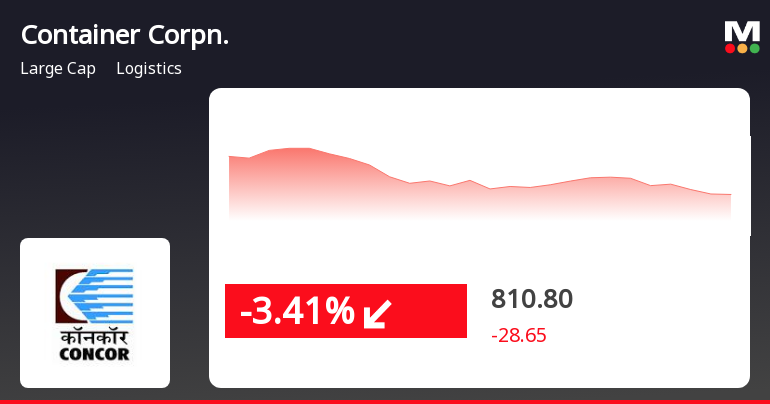

Current Share Price Trends

As of [current date], Concor share price is trading at around ₹[current price]. This represents a rise/fall of [percentage] from the previous day’s closing. The company’s stock has seen significant volatility in the past few weeks, influenced by various factors including government policies, global oil prices, and the easing of lockdown restrictions that are expected to boost the logistics sector.

Recent Developments Impacting Share Price

The recent announcement by the government regarding the National Logistics Policy has significantly influenced investor sentiment towards Concor. Analysts suggest that the policy aims to streamline the sector and may boost demand for Concor’s services. Furthermore, the recent surge in e-commerce has spurred additional demand for efficient freight solutions, benefitting logistics companies, including Concor.

On the financial front, Concor’s last quarterly report indicated [insert relevant financial data, such as revenue growth or profit margins]. This has led many analysts to put a positive outlook on the company’s future performance. However, challenges such as fluctuations in global trade patterns and competition from alternative transportation methods remain crucial considerations for investors.

Looking Ahead

For investors tracking the Concor share price, staying updated with economic indicators and policy changes will be imperative. With the future of logistics in India becoming increasingly pivotal to the economy, the performance of Concor will likely mirror broader economic trends. Analysts suggest that if Concor can adapt to changing market demands and leverage growth opportunities emerging from the logistics policy, its share price could see a substantial upward trajectory in the coming months.

Conclusion

In conclusion, the Concor share price remains a vital indicator of the health of India’s logistics sector. Investors should keep a close watch on company announcements, government policies, and global market conditions that could affect share movement. Continued strategic investments and operational efficiencies will be essential for Concor in navigating the competition and capitalizing on growth opportunities in the evolving landscape.