Latest Insights on Adani Enterprises Share Price

Introduction

Adani Enterprises, part of the Adani Group, has been a significant player in India’s economic landscape, engaging in diverse sectors such as energy, resources, logistics, agribusiness, and more. The share price of Adani Enterprises is vital not only for investors but also for analysts and policymakers as it reflects market sentiments and the company’s performance amidst recent economic challenges and changes in regulatory frameworks.

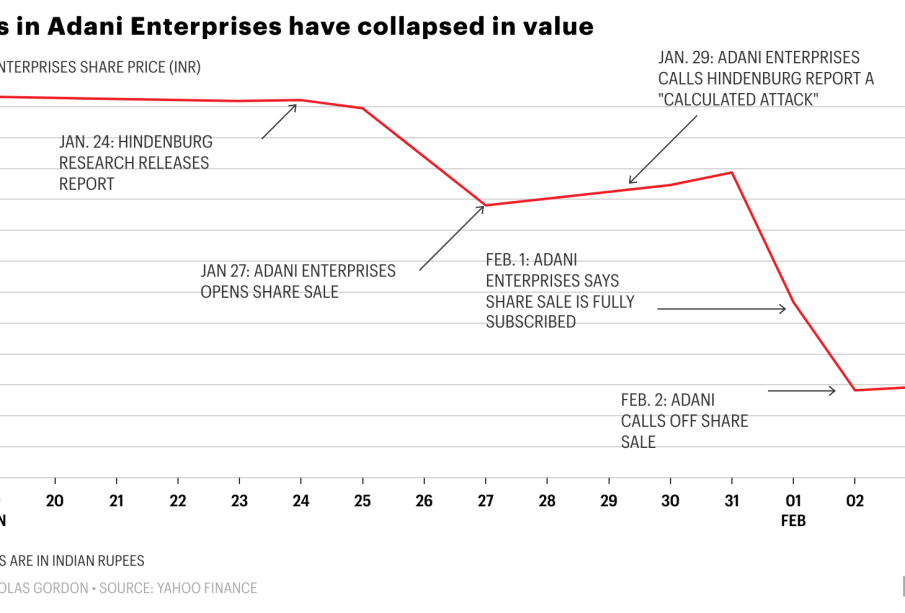

Current Share Price Trends

As of mid-October 2023, the stock price of Adani Enterprises has witnessed notable fluctuations. The share price recently reached ₹1,500, showcasing a robust performance amidst overall market volatility. Analysts attribute this positive movement to favorable quarterly results and strategic expansions in renewable energy investments. In the past month, the stock has surged by approximately 12%, signaling strong investor confidence following a turbulent year.

Factors Influencing Share Price

Several key factors are contributing to the current trend in the share price of Adani Enterprises:

- Regulatory Developments: The company’s compliance with regulatory standards has improved, helping to restore investor confidence dampened by previous controversies.

- Market Conditions: Overall bullish sentiments in the Indian stock market and increased investor interest in infrastructure and renewable energy sectors have uplifted Adani’s stock.

- Financial Performance: The latest financial reports indicated substantial revenue growth, largely driven by the company’s investments in green energy projects, which resonate with global sustainability trends.

Investor Sentiment

Investor sentiment remains cautiously optimistic, with many analysts recommending a ‘hold’ position on the stock. Despite the positive momentum, concerns linger regarding corporate governance and external market risks, particularly amid global inflationary pressures and geopolitical tensions.

Conclusion

In conclusion, the share price of Adani Enterprises is currently experiencing an upward trajectory, driven by positive financials, regulatory improvements, and global market trends towards sustainable investments. However, investors are advised to remain vigilant given the potential volatility and uncertainties that can affect stock performance. As the company continues to innovate and expand its horizons, observers anticipate that its share price will reflect these ongoing developments, making it a noteworthy aspect for future investment strategies.