Kfintech IPO Allotment Status: What You Need to Know

Kfintech IPO Overview

Kfin Technologies, popularly known as Kfintech, is set to make a significant mark in the financial sector with its recent Initial Public Offering (IPO). The IPO is opened for subscription from October 19 to October 21, 2023, aiming to raise substantial capital to bolster its financial footing and expand operations.

Importance of IPO Allotment

The allotment status of an IPO is crucial for investors who participate in the public offering. It determines how many shares are allocated to each investor and plays a significant role in their investment journey. As Kfintech ventures into the stock market, investors are keen to know the allotment process and their respective chances of receiving shares.

Kfintech IPO Allotment Process

The allotment process for the Kfintech IPO will be conducted electronically to ensure transparency and efficiency. The basis of allocation will depend on the demand from investors, which is assessed via the bids received during the IPO period. The final allotment is expected to be announced on October 25, 2023, with shares likely to be credited to investors’ accounts by October 27, 2023, as per the schedule.

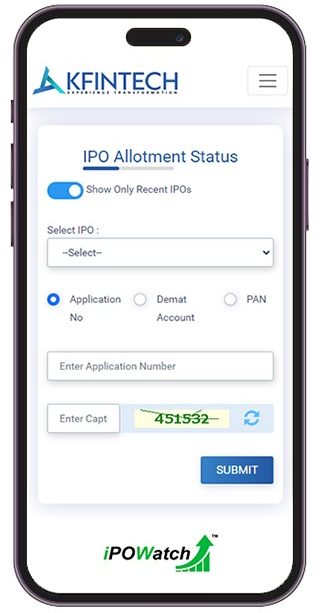

How to Check Allotment Status

Investors can easily check their allotment status through the following methods:

- Visit the official Kfintech IPO webpage.

- Utilize the BSE or NSE websites, where details of allotment will be published.

- Contact their broker for real-time updates.

Market Impact and Future Prospects

The Kfintech IPO is pivotal not just for the company itself but also for the broader market ecosystem. A successful allotment can enhance investor confidence in upcoming public offerings. Analysts suggest that if Kfintech’s IPO receives a lukewarm response, it might impact the valuation of similar fintech firms looking to enter the market in the near future.

Conclusion

In conclusion, the Kfintech IPO allotment status is a significant event for investors and market analysts alike. It reflects not just the company’s potential in the growing fintech landscape but also sets the tone for future IPO activities in India. As investors await the allotment results, the enthusiasm and responsiveness of the IPO can provide insights into market sentiments and investable opportunities in the forthcoming quarters.