Kaynes Technology Share Price: Current Trends and Insights

Introduction

The share price of Kaynes Technology is currently a focal point for investors and analysts, given its recent fluctuations and the overall performance of the technology sector in India. As a provider of advanced technology solutions in areas such as semiconductor design and IoT, the company has gained attention, making it vital for stakeholders to stay informed about its stock performance.

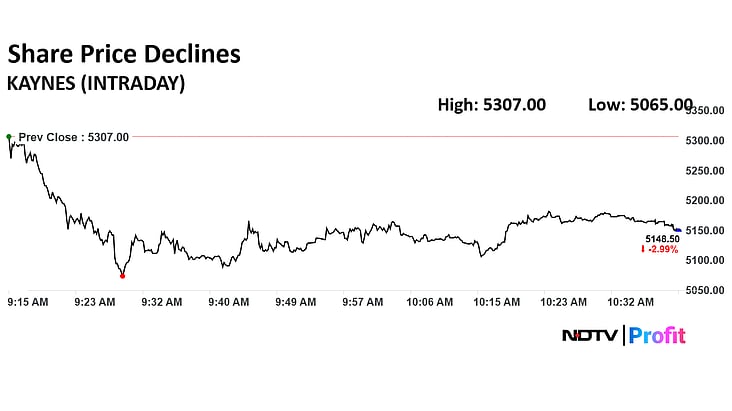

Current Share Price Overview

As of today, the Kaynes Technology share price has seen considerable movement in the market, trading at INR 850, which reflects a modest increase of approximately 2% compared to its previous close. This rise follows recent announcements regarding strategic partnerships and investments aimed at expanding their manufacturing capabilities in high-demand areas like electric vehicle components.

Market Trends and Analysis

The technology sector has been experiencing volatility, influenced by macroeconomic factors such as inflation and global supply chain challenges. However, Kaynes Technology has managed to remain resilient. Analysts attribute this stability to the company’s robust business model and diversification into emerging markets. Market analysts predict that the share price may continue to rise in the coming months as the demand for semiconductor products increases. Furthermore, with the Indian government’s push for initiatives like ‘Make in India’, Kaynes Technology stands to benefit significantly.

Investor Sentiments

Investor sentiments towards Kaynes Technology remain optimistic, driven by the company’s innovative solutions and ambitious growth plans. Shareholder meetings and conference calls have indicated a strong commitment to R&D, with projections suggesting sustained revenue growth through 2024. Recent reports highlight improved profit margins, which further enhances the attractiveness of investing in Kaynes shares.

Conclusion

In summary, the performance of Kaynes Technology’s share price continues to gain traction among both retail and institutional investors. With its strategic initiatives and the favorable business environment in the technology sector, the company is poised for further growth. Investors should keep a close eye on market trends and company announcements, as these will likely dictate the future trajectory of Kaynes Technology shares. Staying informed is crucial for making sound investment decisions in this dynamic landscape.