JBM Auto Share Price – Recent Trends and Analysis

Introduction

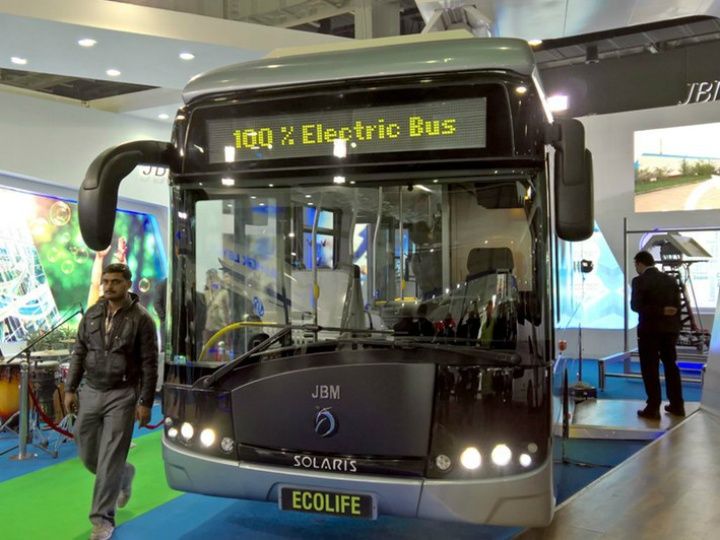

JBM Auto is a prominent player in the Indian automotive sector, specializing in manufacturing auto components and vehicles. The share price of JBM Auto has become a focal point for investors and analysts alike, especially with the increasing interest in electric vehicles (EVs) and sustainable transportation solutions. As of recent months, the developments within the company and the automotive industry at large have significant implications for its stock performance.

Current Market Trends

As of the latest trading session, JBM Auto’s share price is reflecting a gradual upward trend, closing at INR 549.35, a rise of approximately 2.65% from the previous day’s closing. This positive movement can be attributed to various factors including the company’s strategic partnerships and investments in electric vehicle technology. Analysts are optimistic, predicting short-term targets for JBM Auto’s stock to reach around INR 600 within the next few weeks.

Key Factors Influencing Share Price

The growth in JBM Auto’s share price has been influenced by:

- Strategic Alliances: JBM Auto’s collaboration with various EV manufacturers is expected to enhance its market position as demand for electric vehicles increases.

- Retail and Distribution Expansion: The expansion of JBM Auto’s distribution network is likely to contribute positively to its sales and bottom line.

- Industry Growth: The Indian automotive industry is poised for growth, supported by government initiatives towards electric mobility, which positions JBM Auto favorably.

Analysis and Predictions

Market analysts are keeping a close eye on JBM Auto as it navigates this crucial period in the automotive landscape. With the ongoing push for electric vehicles and the government’s supportive policies, JBM Auto’s strategic initiatives appear well-timed. Investment sentiment towards the stock is improving, but it’s essential for investors to consider the volatility that can accompany the auto sector. Experts believe that JBM Auto could witness further appreciation if it continues to deliver on its growth promises and leverage its strategic initiatives effectively.

Conclusion

The fluctuations in JBM Auto’s share price are reflective of broader trends in the automotive industry, particularly with the shift towards a more sustainable future. Investors should remain vigilant, monitoring the company’s progress on its promises, as well as prevailing market conditions. In an era where electric mobility is gaining momentum, JBM Auto is well-positioned to become a key contributor to India’s automotive evolution, making its share price a critical point of interest for stakeholders.