ITR Due Date Extension for Audit Cases in 2023

Importance of ITR Due Date Compliance

The Income Tax Return (ITR) filing deadlines are crucial for individuals and businesses to maintain compliance with tax regulations. The timely filing of ITR helps avoid penalties and interest on delayed payments. However, several factors can complicate this process, notably for audit cases.

Current Developments

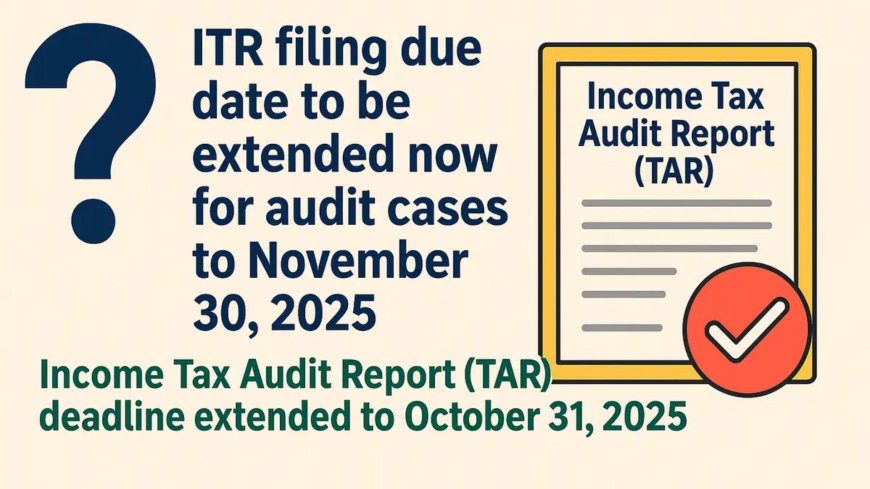

As of October 2023, the Indian government extended the due date for filing ITR for cases requiring audit from September 30, 2023, to October 31, 2023. This extension was announced by the Central Board of Direct Taxes (CBDT) to facilitate taxpayers who faced challenges in preparing their returns due to various reasons, including pandemic-related disruptions and changes in tax compliance protocols.

The audit cases, which apply to businesses and individuals whose annual turnover exceeds the prescribed limits, necessitate detailed scrutiny of financial statements. The extension offers taxpayers additional time to gather necessary documents and ensure accuracy in their filings.

Implications for Taxpayers

The one-month extension is significant as it directly impacts taxpayers’ ability to file accurately and on time. With the added pressure of audits, this breathing room allows taxpayers to consult with tax professionals and rectify any discrepancies that might arise in their accounts.

Furthermore, taxpayers who may have shifted to new accounting practices or accounting software tools this fiscal year have the opportunity to adapt without the stress of immediate deadlines. This is particularly beneficial for smaller businesses and startups that are often ill-equipped for rigorous financial audits.

Future Expectations

As we move towards the end of the fiscal year, it is crucial for taxpayers to remain vigilant regarding any further announcements from the CBDT. Monitoring communication channels and updates will be essential to staying compliant. Taxpayers should also keep abreast of potential future extensions or changes to tax regulations that could impact other aspects of their returns.

Conclusion

The extension of the ITR due date for audit cases serves to alleviate some concerns of taxpayers during a potentially tumultuous economic landscape. For individuals and businesses, understanding and adhering to these deadlines remains essential for maintaining compliance and avoiding unnecessary penalties.