ITC Share Price: Trends and Market Analysis

Introduction

The ITC share price is a focal point for both investors and market analysts in India, reflecting the company’s performance and the economic environment. As one of India’s leading conglomerates with diverse interests, including FMCG, hotels, and agribusiness, ITC’s stock performance plays a crucial role in shaping market sentiments. Investors are keenly observing the stock for insights into the overall economic situation, especially amid the current trends of recovery post-pandemic.

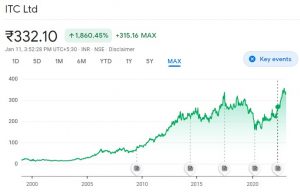

Current Share Price and Performance

As of October 2023, ITC’s share price has been trading at approximately ₹420, representing a notable increase compared to the previous year, where shares hovered around ₹350. This upward trend is attributed to various factors, including robust earnings reports, growth in the FMCG sector, and strategic expansions. The company announced its Q2 earnings, which exceeded market expectations, showcasing a 15% rise in revenue and a 20% increase in net profit compared to the same quarter last year.

Market Drivers

Several key drivers have contributed to the share price increase. First, the FMCG segment has seen strong demand, propelled by increasing consumer spending post-COVID-19. Second, ITC’s commitment to sustainability and innovation has attracted environmentally-conscious investors. Additionally, with the easing of lockdown restrictions leading to improved hospitality and travel sectors, ITC’s hotels and agribusiness verticals are poised for recovery, further enhancing investor confidence.

Analysts’ Outlook

Market analysts are generally optimistic about the prospects for ITC shares. Many experts believe that the company is well-positioned for continued growth due to its diversified business model and market leadership in various sectors. Forecasts suggest that the ITC share price could potentially reach ₹450-₹480 in the next quarter, driven by ongoing product innovations and an expansion strategy.

Conclusion

The ITC share price is indicative of not just the company’s health but also the broader economic sentiment in India. As the economy stabilizes, ITC stands to benefit from its diverse portfolio and strategic initiatives aimed at growth and sustainability. For investors, keeping an eye on ITC’s performance and market conditions will be crucial, as the stock promises potential long-term gains amidst short-term volatility.