ITC Share Price: Live Update, Target and Market Snapshot

Introduction — Why itc share price matters

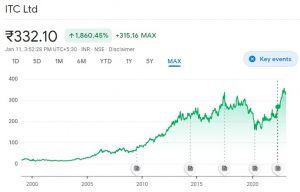

The itc share price is closely watched by equity investors, portfolio managers and retail traders because movements in this stock can influence consumer-sector indices and large-cap portfolios. Current price levels, analyst targets and intraday trading data offer a snapshot of market sentiment and potential upside or downside for investors monitoring ITC.

Main body — Latest trading details and analyst view

In the latest trading session, ITC Ltd is quoted at ₹322.15, showing an increase of ₹3.54 from its previous close. The stock opened at ₹324.60, with the previous close recorded at ₹322.15. Exchange limits stand at an upper circuit of ₹354.35 and a lower circuit of ₹289.95 for the day.

Trading activity for the session shows a volume of 22,352,722 shares and a volume-weighted average price (VWAP) of ₹316.86. The market capitalisation is reported at ₹392,040 crore, reflecting ITC’s scale within the large-cap segment. Among the dataset provided is a 20D figure (listed as 20D) as part of the price metrics.

On the analyst front, S&P Global’s consensus yields a target price of ₹398.11. That target implies a potential upside of about 23.58% relative to the figure of ₹315.10 cited in the S&P Global note. The S&P Global consensus aggregates views from 36 analysts. Note that the S&P Global reference uses a slightly different current price (₹315.10) than the live quote (₹322.15) observed in the latest trading session; such differences can arise from timing or data-source updates.

Conclusion — Implications and near-term outlook

The available data present a mixed but informative picture: a live price near ₹322, moderate intraday volume and a VWAP below the current quote suggest intraday buying interest. The S&P Global target of ₹398.11 signals analyst optimism and points to meaningful upside from the S&P-reported base level. For readers and investors, these figures underline the importance of monitoring price action, volume and updated analyst revisions. Short-term moves will be influenced by market liquidity and news flow, while the indicated analyst target provides a reference point for medium-term expectations.