IRFC Share Price Surges Amid Positive Market Sentiment

Introduction

Indian Railway Finance Corporation (IRFC), the dedicated financier for the Indian Railways, has seen significant fluctuations in its share prices recently. Understanding these changes is crucial for investors and market watchers, especially as they reflect broader economic trends and the growth potential of the Indian Railways sector.

Current Trends in IRFC Shares

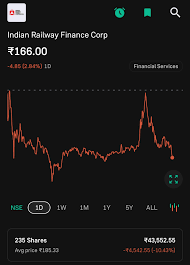

As of the latest trading session, IRFC shares have displayed an impressive upward trend, rising by approximately 5% over the past week. The stock currently trades at ₹25.80, a notable increase from ₹24.50 just a week ago. This positive trend is attributed to several factors, including attractive quarterly results and favorable government policies supporting infrastructure development.

Factors Driving the Increase

1. Government Investments: The Indian government’s continued investment in railway infrastructure has significantly boosted investor confidence. The recent budget allocation of over ₹2.5 lakh crore for the Indian Railways for the fiscal year has reassured shareholders regarding the growth trajectory of IRFC.

2. Financial Performance: IRFC’s recent quarterly results surpassed analysts’ expectations, reporting a 15% increase in net profit year-on-year. This performance has led many financial analysts to revise their estimates upwards, contributing to a more favorable perception of the stock.

3. Market Sentiment: The overall bullish sentiment in the Indian stock market, amid recovering economic conditions post-COVID, has also positively influenced IRFC shares. The utilities and transportation sectors are particularly considered safe investments, attracting investor interest.

Outlook for Investors

The current projections suggest that the IRFC share price may continue to rise as more infrastructure projects are announced in the coming months. Analysts remain optimistic about the company’s future, projecting a similar upward trend in share prices through the end of 2023, assuming continued government support and stable macroeconomic conditions.

Conclusion

The recent surge in IRFC shares highlights the potential for growth within the railway finance sector and reflects broader economic recovery in India. For investors looking to capitalize on market opportunities, keeping an eye on IRFC could be a wise choice as the company continues to play a pivotal role in financing India’s expansive railway network.