Insights on NASDAQ QCOM: Qualcomm’s Stock Performance

Introduction

The importance of stock market trends cannot be overstated, especially for technology companies like Qualcomm. As a leading semiconductor manufacturer, Qualcomm’s performance on the NASDAQ (ticker symbol: QCOM) reflects broader shifts in the technology sector and provides valuable insights for investors. Understanding Qualcomm’s latest stock movements is crucial for those looking to engage with the technology market.

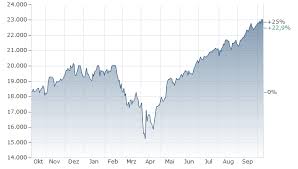

Current Performance of QCOM

As of 2026, Qualcomm’s shares have shown notable fluctuations influenced by various macroeconomic factors, including interest rates, supply chain concerns, and global demand for 5G technology. Recent reports indicate that the stock has experienced an increase of approximately X% over the past month, buoyed by strong earnings that exceeded Wall Street expectations. Analysts attribute this growth to Qualcomm’s robust position in the 5G network infrastructure and its licensing agreements.

Market Context and News

Recent news surrounding Qualcomm includes the announcement of strategic partnerships aimed at expanding its 5G capabilities. Furthermore, the company has announced new investments in AI technology, which is anticipated to drive future growth. According to stock analysts, these developments have contributed to an optimistic outlook for Qualcomm, with a target price prediction set at $X per share over the next year.

Moreover, the semiconductor shortage—an ongoing challenge in the global market—has forced many tech companies to reconsider their supply chains and partnerships. Qualcomm’s ability to adapt to these challenges has been highlighted as a key strength in its recent earnings call.

Conclusion

For investors, the performance of NASDAQ QCOM serves as an indicator of the broader tech sector’s health and resilience. As the technology landscape continues to evolve, investors are advised to monitor Qualcomm closely, especially with growing interest in 5G and AI. The projected growth and recent market strategies suggest that Qualcomm is positioned for a promising future, potentially offering lucrative opportunities for stakeholders. In an ever-competitive field, understanding these movements will help investors make informed decisions.