Insights on Bank of Maharashtra Share Price Trends

Introduction

The Bank of Maharashtra, one of India’s leading public sector banks, plays a crucial role in the financial landscape of the country. Understanding the share price movements of the bank is essential for investors and stakeholders in assessing its performance and future growth potential.

Current Share Price Trends

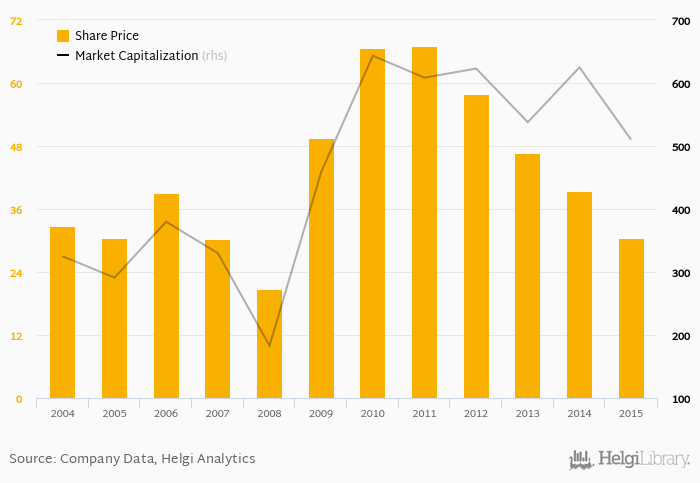

As of October 2023, Bank of Maharashtra’s share price has shown significant volatility, reflecting broader market trends as well as specific developments within the bank itself. Recent reports indicate that the share price is hovering around ₹30, which represents a steady growth of over 10% in the last few months, attributed to improved financial performance and a positive outlook from analysts.

Market Factors Influencing Share Price

The factors influencing the share price include the bank’s quarterly earnings results, changes in interest rates, and broader economic performance in India. The recent quarterly report indicated a rise in net profits and a decrease in non-performing assets (NPAs), both of which bolster investor confidence. Additionally, the ongoing digitization efforts by the bank have attracted positive market sentiment, as they position the bank to tap into the growing fintech space.

Future Outlook

Looking ahead, analysts predict that Bank of Maharashtra’s share price may continue to rise, driven by favorable macroeconomic conditions and effective management strategies. The bank’s focus on expanding its retail loan segment and increasing its presence in rural areas is expected to enhance its profitability. Furthermore, as the Indian economy recovers from various challenges, the banking sector, in general, is likely to thrive.

Conclusion

In conclusion, the Bank of Maharashtra’s share price remains a topic of keen interest among investors. With a promising financial outlook and strategic initiatives in place, the bank’s shares present a compelling case for those looking to invest in the public sector banking space. Potential investors should keep an eye on the bank’s performance and market conditions to make informed decisions moving forward.