Insights into Polycab Share Performance

Introduction

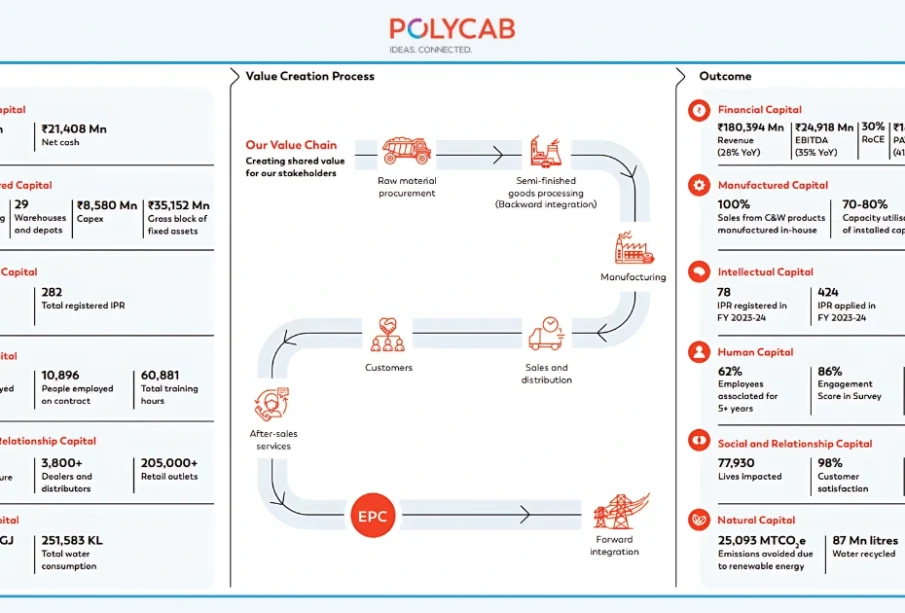

Polycab India Ltd, a leader in electrical and telecom cables, continues to draw significant interest in the stock market. As investors seek opportunities in the ever-evolving sectors of technology and infrastructure, understanding Polycab’s share performance is paramount. This article highlights recent developments, financial outlook, and what they mean for potential investors.

Current Market Performance

As of October 2023, Polycab shares have been displaying a mixed performance on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE). The stock opened at ₹1,200 and has experienced fluctuations largely attributed to market sentiments and global economic factors. Despite some volatility, Polycab’s share price has shown resilience, mostly due to steady demand in the cable and wire industry, buoyed by infrastructure projects in the country.

Recent Developments

Recently, Polycab reported its quarterly earnings, which surpassed analysts’ expectations, recording a year-on-year revenue growth of approximately 20%. This robust performance is largely fueled by increased sales in its cables and wires segment, which accounts for a significant portion of its overall revenue. Additionally, the company is expanding its product lines and investing in innovation, positioning itself strongly against competitors.

The successful launch of new initiatives, such as smart electrical products and sustainable energy solutions, further enhances Polycab’s market appeal. Given the Indian government’s push towards renewable energy and smart city projects, Polycab is well-placed to benefit from these trends moving forward.

Future Projections

Market analysts are optimistic about Polycab’s growth trajectory, with many projecting that the share price could rise by up to 15% over the next year, depending on market conditions and the company’s ability to execute its strategic plans. This positive outlook is reinforced by the company’s strong balance sheet, which indicates a healthy cash flow and effective cost management strategies.

Conclusion

The potential for growth and innovation within Polycab positions it as a noteworthy investment in the electrical segment. As the industry continues to expand and evolve, the performance of Polycab shares will be critical indicators for investors looking to navigate the equities market effectively. With the right strategies, the company’s shares can offer not only immediate returns but long-term stability in a competitive sector. Investors are encouraged to keep a close watch on market trends and company announcements to make informed decisions.