Insights into ICICI Bank Share Performance in 2023

Importance of ICICI Bank Share

ICICI Bank, one of India’s leading private sector banks, has a significant impact on the financial market. Understanding its share performance is crucial for investors, analysts, and anyone interested in the Indian economy. The bank’s stock is a vital indicator of the banking sector’s health and overall market sentiment.

Current Share Performance

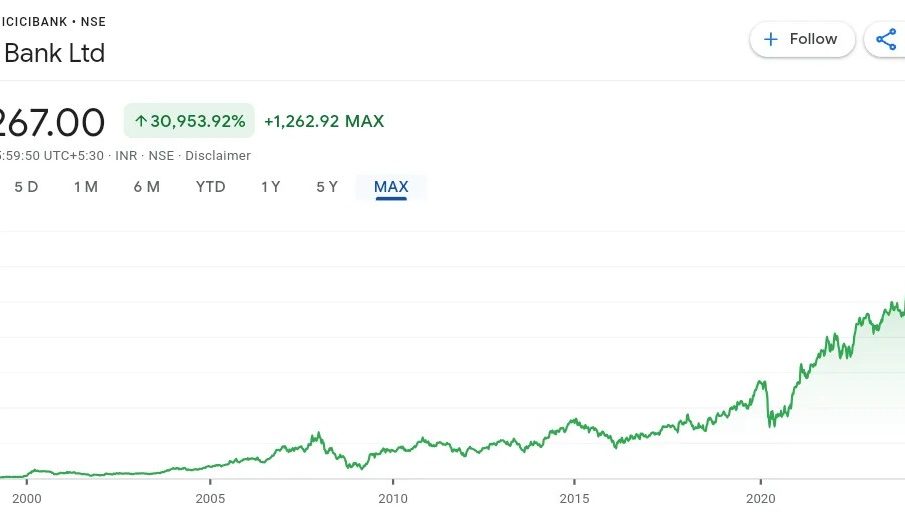

As of October 2023, ICICI Bank’s share price has shown remarkable resilience, currently trading around ₹950 per share, reflecting a considerable year-to-date growth of approximately 25%. Analysts attribute this performance to robust loan growth, improved asset quality, and a strong net interest margin. For instance, the bank reported a net profit increase of 30% year-on-year in the last quarter, showcasing its ongoing recovery and customer acquisition strategy.

Factors Influencing Share Prices

Several factors have contributed to ICICI Bank’s impressive share price. Economically, a recovering post-pandemic environment has uplifted consumer and business sentiments, increasing loan demand. Furthermore, ICICI Bank’s proactive measures in digital banking and risk management have positioned it as a market leader.

Additionally, regulatory support from the Reserve Bank of India (RBI) in terms of lower interest rates has facilitated increased lending. This, coupled with a decrease in non-performing assets (NPAs), has boosted investor confidence significantly.

Future Outlook

Looking ahead, many analysts predict that ICICI Bank’s shares will continue to perform well, potentially hitting new highs by the end of 2023. The ongoing digital transformation and focus on retail banking could yield substantial dividends. However, investors are also advised to stay cautious of ongoing global economic uncertainties, which may affect the banking sector’s growth trajectory.

Conclusion

In conclusion, ICICI Bank’s share performance remains an essential aspect of the Indian stock market. Its current growth trajectory, bolstered by strong financial fundamentals and favorable economic conditions, paints a promising picture for both long-term investors and short-term traders. Staying updated with market trends and company announcements will be key for any investor looking to maximize their returns with ICICI Bank shares.