Infy Share Price: Current Trends and Market Insights

Introduction

The share price of Infosys Limited (commonly known as Infy) holds significant importance for investors and analysts, given its status as one of India’s leading IT services companies. With the stock market being a barometer of economic health, fluctuations in Infy’s share price can provide insights into broader market trends and investor sentiment.

Current Trends

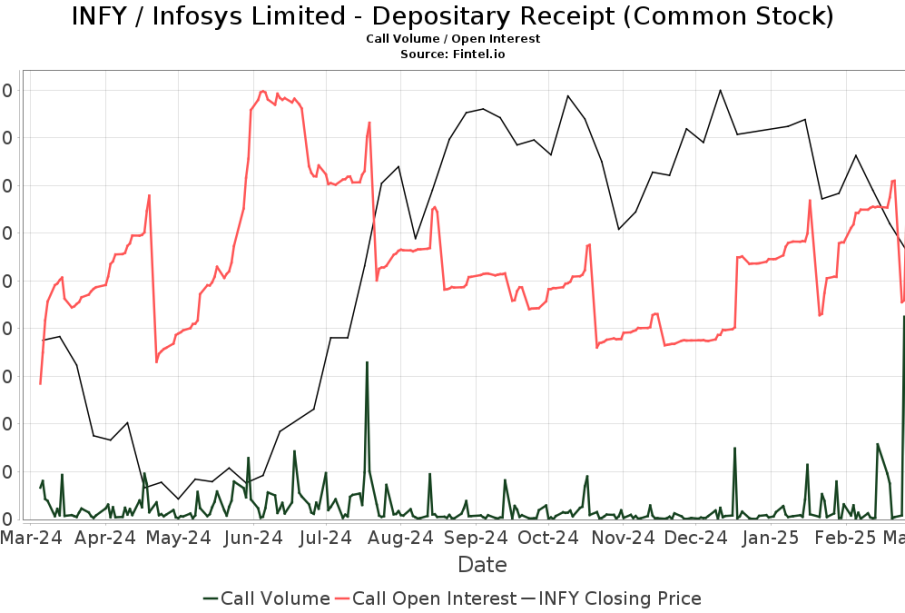

As of October 2023, Infy’s share price has experienced notable volatility, mirroring global economic conditions and domestic factors such as quarterly earnings reports and macroeconomic policies. The stock opened this month at ₹1,580, reflecting a steady growth trajectory over the past few months as demand for digital transformation grows across sectors.

During the last trading session, the share price peaked at ₹1,620, driven by strong quarterly results that exceeded market expectations. The company reported a 15% increase in revenue year-over-year, and a robust order book indicating confidence among investors. Analysts suggest that the company’s focus on cloud computing and AI-driven solutions is expected to bolster its growth further.

Market Factors Influencing Infy Share Price

Several factors continue to influence the share price of Infosys:

- Global Demand for IT Services: As enterprises increase their dependence on technology, the demand for IT services has surged, benefitting companies like Infosys.

- Quarterly Results: Earnings reports serve as a critical indicator of financial health and can cause fluctuations in share price.

- Regulatory Changes: Changes in IT regulations, both domestic and international, can impact operational costs and ultimately the share price.

- Broader Market Sentiment: The overall performance of the stock market, influenced by interest rates, inflation, and geopolitical tensions, can also affect share movement.

Conclusion

As they monitor Infosys’ share price, investors should stay informed about market trends and company performance. With its current focus on enhancing its cloud capabilities and adopting AI technologies, Infosys appears well-positioned for future growth. Analysts predict that if current trends continue, Infy’s share price may stabilize around ₹1,600-₹1,700, barring any unforeseen market disruptions. As always, potential investors should conduct thorough research and consult financial advisors before making investment decisions.