Infosys Announces Buyback: What It Means for Investors

Introduction

The recent announcement of a buyback program by Infosys, one of India’s leading IT services companies, has sparked significant interest across the financial and tech sectors. This move is seen as a strategic effort to enhance shareholder value and reflects the company’s strong financial health. With many investors looking for reassurances in today’s volatile market, this buyback initiative becomes a crucial point of discussion.

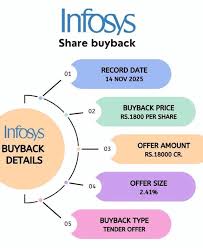

Details of the Buyback

On October 16, 2023, Infosys revealed plans to buy back equity shares worth ₹9,300 crore (approximately $1.2 billion). The buyback program comes as the company’s stock has seen fluctuations amid global economic uncertainties and its own shifting business dynamics. The buyback is priced at ₹1,850 per share, which represents a premium over the market price at the time of the announcement, indicating the management’s confidence in the company’s future prospects.

Context and Financial Performance

Infosys has maintained a robust performance over the past fiscal year, reporting a revenue increase of 10% year-over-year in Q2 2023. The decision to execute a buyback is viewed as a method to return excess cash to shareholders, particularly as the company has a cash reserve exceeding ₹38,000 crore (around $4.6 billion). This strong cash position is a testament to Infosys’s strategic operations and prudent financial management.

Market Response and Implications

Investor reactions to the buyback announcement have generally been positive, with shares witnessing an uptick following the news. Market analysts suggest that share buybacks can signal to the market that a company believes its stock is undervalued, thereby instilling confidence among investors. As companies globally increasingly use buybacks as a tool for capital allocation, Infosys’s initiative aligns with this trend, particularly in the tech sector, where firms must continually innovate and return value to shareholders.

Conclusion

The Infosys buyback program not only serves as a financial strategy to boost shareholder value but also positions the company favorably against its competitors in the tech industry. As the market evolves, this move may resonate well with investors seeking stability and confidence in a time of uncertainty. Looking ahead, Infosys’s continuing commitment to financial health and shareholder returns could set a benchmark for other firms within the sector to follow. Investors will no doubt be keeping a close eye on Infosys’s future performance as the buyback program unfolds.