IndusInd Bank Share Price: Current Trends and Analysis

Introduction

The share price of IndusInd Bank has garnered considerable attention from investors and analysts alike in recent weeks. Being one of the leading private sector banks in India, any fluctuation in its stock can signal broader trends in the financial sector. Understanding the current share price is vital for investors looking to make informed decisions in a rapidly changing market.

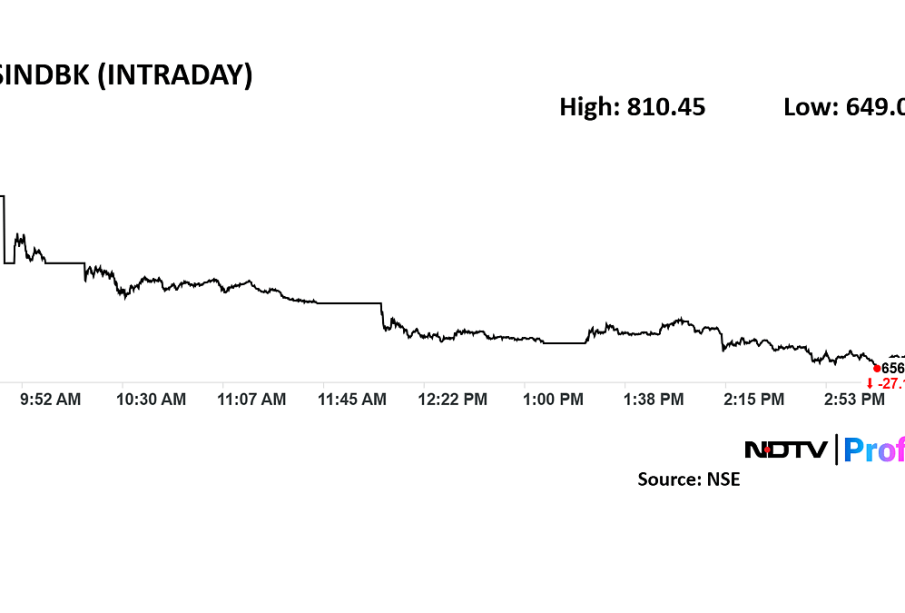

Current Share Price Trends

As of October 2023, IndusInd Bank’s share price has shown a significant movement, hovering around INR 1,180. This reflects a notable increase from its price earlier in the year, indicating a positive response from the market. The bank’s Q2 results, posted recently, highlighted improved Net Interest Income (NII) and better asset quality ratios, contributing to this rise.

Market Factors Influencing the Share Price

Several factors are influencing IndusInd Bank’s share price, with the most significant being its quarterly performance reports, macroeconomic indicators, and competitive positioning in the banking sector. Analysts have pointed out that the bank has been successful in improving its retail loan book, which has been a critical growth area following the economic recovery post-pandemic. Additionally, the Reserve Bank of India’s monetary policy, which has maintained a stable interest rate, has also played a role in the bank’s performance.

Analyst Opinions

Market analysts remain optimistic about IndusInd Bank’s stock potential, citing strong fundamentals and an expanding customer base. Most analysts have assigned a ‘buy’ rating, projecting that share price could reach as high as INR 1,350 in the next 12 months. The consensus is that the bank’s focused approach on leveraging technology for customer service and efficiency will provide a competitive edge.

Conclusion

The share price of IndusInd Bank presents a promising opportunity for both short-term and long-term investors. With a sound banking strategy and consistent performance metrics, the bank is well-positioned to navigate the evolving market landscape. Investors are advised to conduct their due diligence and consider economic indicators before making investment decisions. As the financial landscape continues to evolve, IndusInd Bank can be a significant player to watch in the upcoming months.