Indosolar Share Price: Trends and Market Insights

Introduction

Indosolar Ltd., a leading player in India’s solar energy sector, has garnered attention due to the growing demand for renewable energy solutions. As the nation pushes towards achieving its ambitious green energy targets, the performance of Indosolar’s shares is becoming increasingly relevant for investors and stakeholders in the renewable energy market. Understanding the fluctuations in Indosolar’s share price not only helps investors make informed decisions but also reflects broader trends within the solar industry.

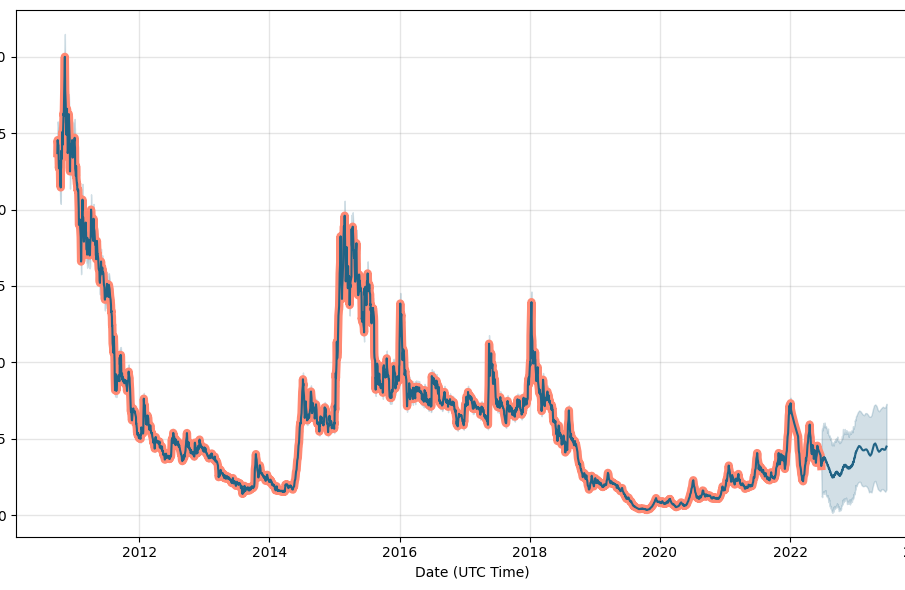

Recent Share Price Trends

As of the latest market data, Indosolar’s share price has seen a significant increase, buoyed by favorable government policies aimed at bolstering the renewable energy sector. Over the past month, the stock price has surged by over 15%, following the announcement of new solar projects and enhancements in the production capabilities of the company. Investors have reacted positively, encouraged by reports of quarterly profits that exceeded analysts’ expectations, contributing to the current valuation of Rs. 45 per share.

Market Drivers

A number of factors are influencing the current share price of Indosolar. Key among these is the Indian government’s commitment to the National Solar Mission, which aims to generate 100 GW of solar power by 2022. This initiative boosts market confidence and raises prospects for companies like Indosolar, which specializes in manufacturing photovoltaic cells and modules. Moreover, recent voluntary production-linked incentive schemes have provided additional financial support, enhancing operational efficiencies.

Future Outlook

Experts forecast that Indosolar’s share price may continue to rise in the upcoming quarters as the company is positioned to benefit from increasing demand for clean energy solutions. With solar energy witnessing a revival post-pandemic, analysts predict that investments in the sector will escalate, directly impacting the performance of shares of solar companies. Nevertheless, potential challenges such as fluctuating raw material prices and geopolitical risks could present headwinds for the company’s growth.

Conclusion

In summary, the trajectory of Indosolar’s share price holds substantial implications for investors and the renewable energy market at large. With a positive outlook driven by government support and infrastructural enhancements, Indosolar is poised to capitalize on future opportunities. As the green energy sector evolves, keeping a close watch on share price movements will be critical for stakeholders looking to navigate this dynamic landscape.