IndiQube IPO Allotment Status: What Investors Need to Know

Introduction

In recent years, Initial Public Offerings (IPOs) have gained immense traction in the Indian stock market, drawing both retail and institutional investors. The launch of IndiQube’s IPO has created significant buzz, highlighting the company’s expansion in the commercial real estate sector. With increasing interest in this public offering, understanding the IndiQube IPO allotment status is crucial for potential investors…

Understanding IndiQube’s IPO

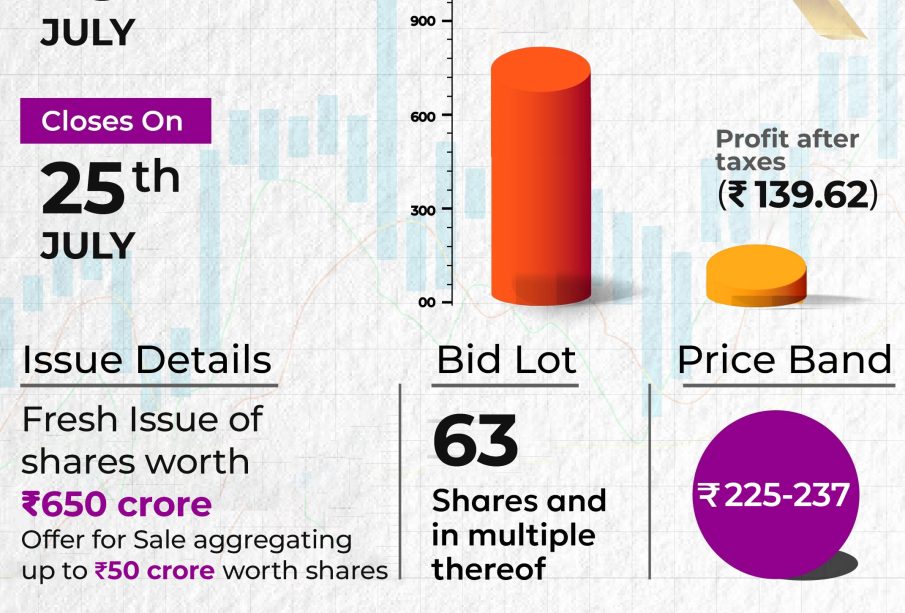

IndiQube, which specializes in providing flexible workspace solutions, opened its IPO for subscription recently, attracting substantial interest due to the booming demand for coworking spaces in India. The IPO was launched on [insert dates here], offering [insert number] shares to the public at an indicative price band of ₹[insert range]. This move is pivotal as it will provide IndiQube with the necessary capital to finance its expansion plans across the country.

Allotment Process and Key Dates

The allotment of shares from the IndiQube IPO commenced on [insert date]. Investors are keen on knowing their allotment status as it determines whether they have successfully secured shares in this promising venture. Based on recent trends, GOI, SEBI regulations, and investor interest, the allotments are expected to be announced shortly after the close of the subscription period.

How to Check Allotment Status

Investors can conveniently check the allotment status for the IndiQube IPO through various methods. Typically, they can visit the official website of the registrar handling the IPO, such as [insert registrar name], or use the online platforms provided by their brokers. The procedure usually involves entering the PAN number or application number to get real-time updates on allotment status.

Conclusion and Future Outlook

As the allotment status release date approaches, anticipation builds among investors viewing IndiQube’s potential to carve out a strong position in the flexible workspace market. Depending on the response to the allotment, this IPO could set the tone for upcoming offerings in the sector. Investors should stay tuned for the announcement to engage effectively in future trading activities.