Impact of Federal Reserve Interest Rate Cut on the Economy

Introduction

The Federal Reserve’s decision to cut interest rates plays a crucial role in shaping the United States economy and influencing global financial markets. This action, often undertaken to stimulate economic growth, is particularly significant given the current economic climate characterized by rising inflation and uneven recovery from the COVID-19 pandemic.

Recent Events

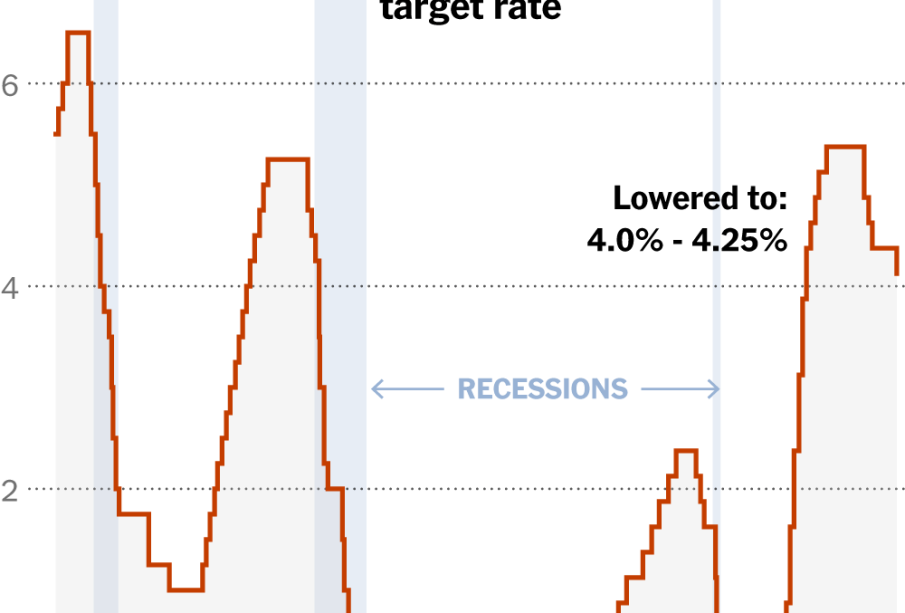

On October 25, 2023, the Federal Reserve announced a 0.25% reduction in its interest rate target, bringing it down to 4.25% in light of softer-than-expected economic data. This decision comes after months of deliberations and feedback from various sectors of the economy regarding consumer spending, job growth, and inflation rates. The central bank cited the need to support economic growth amidst concerns of a potential recession, as indicators show a decline in manufacturing activity and consumer confidence.

Federal Reserve Chair Jerome Powell stated, “We recognize the importance of responding to economic indicators, and our aim is to ensure that the economy continues on a stable path of growth.” The rate cut is expected to lower borrowing costs for consumers and businesses, which could enhance spending and investment in the short term.

Market Reactions

The immediate reaction to the interest rate cut was felt across various financial markets. Stock indices, including the Dow Jones Industrial Average and the S&P 500, recorded gains as investors welcomed the news with optimism. Meanwhile, the bond market experienced fluctuations with a decrease in yields as the Fed’s decision suggests a more accommodative monetary policy.

Conclusion and Implications

In conclusion, the Federal Reserve’s interest rate cut is a significant development that holds various implications for both the U.S. economy and international markets. Economists predict that this move could lead to increased consumer spending, helping to mitigate recession risks. However, experts also caution that while lower rates can spur growth, they may not quickly alleviate inflationary pressures that remain a concern for policymakers.

The effects of this rate cut will likely unfold over the coming months, and its impact on inflation rates and employment will be closely monitored. As we head into 2024, investors and economists alike will be watching for further decisions from the Federal Reserve, which will be crucial in navigating the economic landscape.