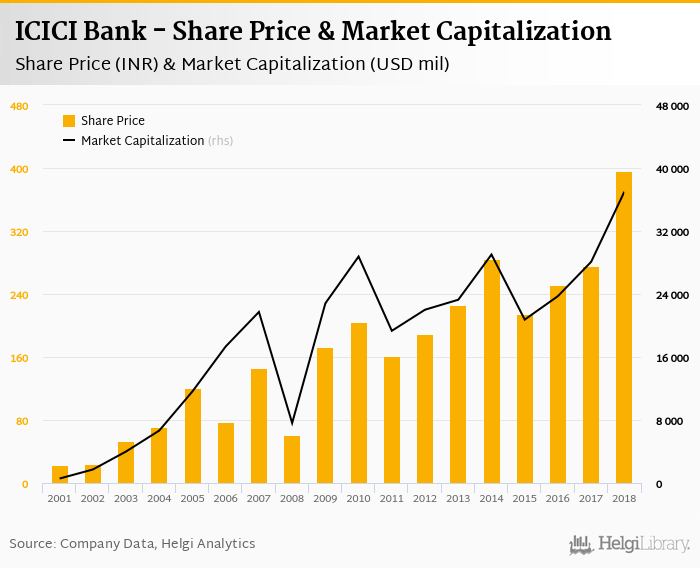

ICICI Bank Share Price: Recent Trends and Market Impact

Introduction

The financial sector is a crucial indicator of a country’s economic health, and bank stocks often serve as a benchmark. Among these, ICICI Bank’s share price remains a significant focus for investors and analysts. With the bank’s performance influencing market sectors and investor sentiment, understanding its share price trends is vital for both seasoned investors and newcomers.

Current Trends in ICICI Bank Share Price

As of October 2023, ICICI Bank’s share price has seen notable fluctuations. Recently, the stock closed at INR 935, showcasing an increase of 2.5% in just one week. This uptrend is primarily attributed to investor confidence bolstered by the bank’s robust quarterly earnings report, which showed a 20% year-on-year growth in net profit. Such financial performances contrast positively with the broader market, which faces volatility.

Market Influences and Investor Sentiment

The stock market is influenced by several key factors, including interest rates, government policies, and economic indicators. ICICI Bank, as one of India’s leading private banks, is often seen as a bellwether for the banking sector. Analysts have pointed out that the recent policy changes aimed at improving liquidity and growth prospects have positively impacted the bank’s share price.

Furthermore, with India’s economy poised for recovery post-pandemic, and increased credit demand observed across sectors, investors are optimistic about the bank’s future growth trajectory. Market analysts predict that if this trend continues, we could see ICICI Bank’s shares venture beyond the INR 1000 mark by early 2024, given the ongoing positive sentiment.

Conclusion

In summary, ICICI Bank’s share price reflects significant upward momentum influenced by excellent earnings and a positive macroscopic economic environment. The current trends and forecasts showcase a promising outlook for investors engaged in banking stocks. As always, potential investors should closely monitor market conditions and bank performance metrics to make informed decisions. Understanding these dynamics will be key to navigating the evolving landscape of the Indian banking sector in the coming months.