ICICI Bank Share Price: Key Drivers and Investor Outlook

Introduction: Importance of ICICI Bank Share Price

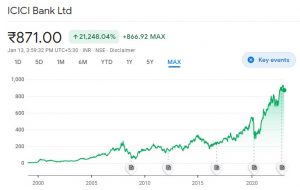

The ICICI Bank share price is closely watched by domestic and international investors because the bank is one of India’s largest private sector lenders. Movements in its stock often reflect broader trends in the banking sector, credit growth expectations, and investor sentiment toward Indian financial markets. For retail and institutional investors alike, changes in ICICI Bank’s stock can influence portfolio allocations and signal shifts in macroeconomic confidence.

Market Factors Affecting the Share Price

Several structural and cyclical factors typically drive the ICICI Bank share price. Earnings performance, loan growth, net interest margins, and asset quality are central to how analysts value the stock. Monetary policy decisions by the Reserve Bank of India, inflation trends, and interest rate expectations affect margins across the banking sector and thus influence ICICI Bank’s valuation. In addition, global risk appetite and foreign institutional investor flows can amplify share price moves, especially during periods of heightened global volatility.

Corporate actions and strategic initiatives—such as capital raising, mergers, technology investments, and efforts to expand retail banking—also shape investor perceptions. ICICI Bank’s digital platforms and retail franchise are often cited as competitive strengths, while credit cost trends and non-performing asset management remain key risk areas that market participants monitor closely.

Investor Sentiment and Short-term Dynamics

Short-term fluctuations in the ICICI Bank share price can be driven by quarterly results, management commentary, regulatory updates, and macroeconomic data releases. Analysts frequently re-evaluate forecasts after earnings announcements or following changes in guidance on asset quality and provisioning. Technical trading factors and liquidity on the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) can produce intraday volatility, but longer-term investors tend to focus on the bank’s fundamentals and growth trajectory.

Conclusion: What Readers Should Watch

Investors tracking the ICICI Bank share price should monitor upcoming quarterly results, RBI policy decisions, credit growth indicators, and any regulatory developments affecting banks. While the bank’s robust retail presence and digital capabilities are positive factors, vigilance on asset quality and margin pressures is important. A balanced approach—combining fundamental analysis and awareness of macro and liquidity trends—can help market participants form a reasoned view on potential risks and opportunities related to ICICI Bank’s stock.