HDFC Credit Card Lounge Access Changes: What You Need to Know

Introduction

The recent changes in lounge access policies for HDFC credit cardholders are significant news in the financial sector. Lounge access is a valued benefit for many credit card users, particularly for frequent travelers. Understanding these changes is essential for cardholders to maximize their travel experiences and benefits.

Details of the Changes

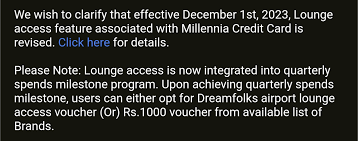

HDFC Bank has announced alterations to its lounge access policy, which will probably take effect from November 1, 2023. Previously, credit cardholders could enjoy complimentary access to select airport lounges based on their card type, with conditions varying across different credit cards. With the recent update, HDFC has made several key adjustments to improve the clarity of this benefit.

The primary change involves a reduction in the number of complimentary visits allowed for standard credit cards such as the HDFC Regalia and HDFC Millennia. The Regalia card used to offer 12 complimentary visits annually, but this will now be reduced to 6 visits. Similarly, the HDFC Millennia cardholders will see their number of complimentary lounge accesses drop from 8 to 4 visits annually. However, premium credit products will continue to offer lucrative lounge access perks, maintaining unlimited visits for higher-tier members.

Conditions for Access

In addition to the number of visits, HDFC Bank is now implementing stricter policies regarding the usage of these lounges. Cardholders are required to verify access through the HDFC Bank mobile app, ensuring they meet the necessary eligibility criteria based on their credit card type. Furthermore, while entry is complimentary, additional guests accompanying a cardholder will incur a fee, a shift from the previous policy where some lounges permitted guests without charge.

Conclusion

These changes in HDFC credit card lounge access reflect the bank’s intention to recalibrate its offerings and adapt to user experiences and operational costs. For frequent travelers relying on lounge access, it’s essential to stay informed about these developments to plan their travels accordingly. As more banks compete in the credit card space, customers are advised to review the benefits of their cards and consider potential alternatives that might better suit their travel needs. Future adjustments could further reshape the travel-related offerings of credit cards, enhancing the competition among financial institutions in India.