GST Petrol Diesel Rate: Key Updates and Implications

Introduction

The Goods and Services Tax (GST) on petrol and diesel has long been a topic of debate and concern in India. As fuel prices directly affect the economy, transportation costs, and the price of goods, understanding the GST implications on these fuels is crucial for consumers and businesses alike. Recently, discussions have intensified regarding the GST framework for petrol and diesel, emphasizing its potential effects on inflation and the overall economic landscape.

Current GST Status on Petrol and Diesel

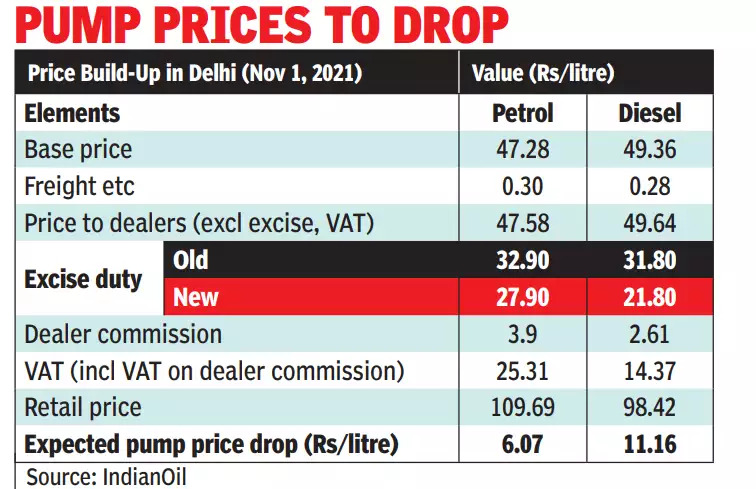

As of now, petrol and diesel are not included in the GST framework, which means they are subject to state and central taxes. This has led to significant disparities in fuel prices across different states in India. According to the Ministry of Petroleum and Natural Gas, the current base prices for petrol and diesel vary, with rates pegged at around ₹107 per liter for petrol and ₹95 per liter for diesel as of October 2023.

Recent Developments

In light of rising fuel prices and public discontent, the GST Council recently convened to discuss the possible implementation of GST on petrol and diesel. Key points from the meeting revealed the following:

1. **Subsidization Discussions**: Some states have proposed subsidies to offset GST impacts, indicating a willingness to consider changes in taxation to maintain affordability.

2. **Tax Rate Considerations**: While some officials favor integrating these fuels into the GST system, concerns regarding the balance of state and central revenues remain a pivotal part of the discussion.

3. **Economic Implications**: Experts suggest that implementing GST could stabilize fuel prices across states and reduce consumer burden, but this needs careful assessment of tax rates to avoid inflation.

What Does This Mean for Consumers?

The potential shift to a GST framework for petrol and diesel could result in more predictable pricing and ease of compliance for businesses. However, the rates at which these fuels would be taxed under GST remain uncertain. If the tax rate is set too high, it could lead to increased prices for consumers at the pump, countering any benefits from a unified tax structure.

Conclusion

The ongoing discussions regarding GST rates for petrol and diesel underscore the sensitivity of fuel pricing in India. As markets fluctuate and inflation remains a concern, the outcomes of these deliberations will be crucial for consumers and businesses alike. Stakeholders are encouraged to pay close attention to announcements from the GST Council in the coming months, as changes could dramatically impact the cost of living and operational expenses across the country.