Gold Prices Today: Key Trends and Market Insights

Introduction

Gold has long been regarded as a safe-haven asset, especially in times of economic uncertainty. For investors and consumers alike, knowing the latest gold prices today is crucial for making informed decisions. As of today, gold prices are influenced by various global factors, including economic data releases, geopolitical tensions, and changes in the currency market.

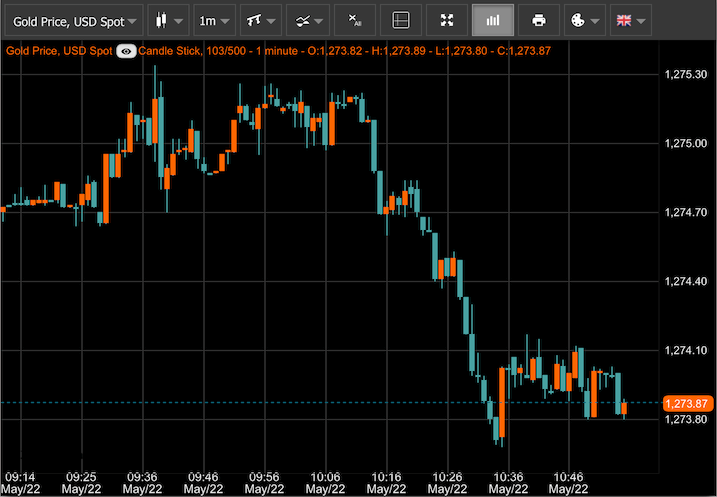

Current Gold Price Trends

As of today’s trading, gold prices are trading at ₹58,000 per 10 grams in India, marking an increase of ₹300 from the previous session. Analysts attribute this rise to a combination of weaker-than-expected U.S. economic indicators and rising inflation concerns. Globally, gold prices are hovering around $1,800 per ounce, reflecting similar trends influenced by global market conditions. The demand for gold jewelry and investment has seen a resurgence following the recent festive seasons in India, further supporting prices.

Factors Influencing Gold Prices

Several factors have contributed to the fluctuations in gold prices today:

- U.S. Economic Data: Recent reports showed slower job creation, indicating a potential slowdown in economic growth, which typically boosts gold’s appeal as a safe investment.

- Geopolitical Tensions: Ongoing tensions in Eastern Europe and trade issues have resulted in higher investor demand for gold as a store of value.

- Inflation Concerns: With inflation rates soaring in various economies, investors are flocking to gold, believing it to be a hedge against the diminishing value of currency.

Conclusion

The recent upward trend in gold prices is likely to continue as investors keep an eye on economic indicators and geopolitical developments. For those considering investing in gold, it is essential to stay informed about market dynamics and trends.

In summary, as of today, gold remains a significant investment option and a reliable asset in uncertain economic times. Future forecasts suggest that gold prices could continue to rise, driven by ongoing economic and geopolitical factors. Therefore, consumers should remain vigilant about the fluctuating market prices of gold.