GNG Electronics IPO Allotment Date: What You Need to Know

Introduction

The upcoming GNG Electronics IPO has garnered significant attention among investors, due to the company’s robust growth trajectory and the rising demand for electronic products in India. As one of the key players in the electronics sector, GNG Electronics aims to raise capital for expansion and innovation. Understanding the IPO allotment date is crucial for potential investors looking to acquire shares and benefit from the company’s growth.

Details of the GNG Electronics IPO

GNG Electronics has announced its initial public offering (IPO) which is set to be launched on November 7, 2023, and will remain open for subscription until November 9, 2023. The company is looking to raise approximately ₹1,000 crore through this IPO, which includes fresh issue of shares worth ₹700 crore and an offer for sale of ₹300 crore by existing shareholders.

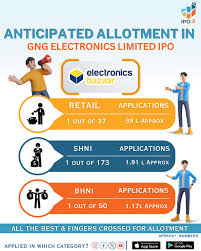

The shares are expected to be priced in the range of ₹250 to ₹270 per share, which is a competitive rate given the current market dynamics. Maximum shares that can be allotted to retail investors in this IPO is 35%. The allotment date is tentatively set for November 14, 2023, and the shares will subsequently be listed on the BSE and NSE on November 17, 2023.

Market Conditions and Significance

The timing of the GNG Electronics IPO is significant as the Indian electronics market is experiencing explosive growth, driven by increasing consumer demand and government initiatives aimed at boosting domestic manufacturing. The Union Government’s ‘Make in India’ initiative has further solidified the foundation for firms like GNG Electronics to thrive.

Market experts analyze that given the company’s strong financial performance, with a reported revenue growth of 30% year-on-year, GNG Electronics’ IPO is likely to attract considerable interest from institutional and retail investors alike.

Conclusion

The GNG Electronics IPO allotment date is crucial for investors who wish to engage with a promising company in the electronics sector. As the company prepares for its listing, potential investors are advised to closely monitor the allotment process and be ready for the shares to hit the market on November 17. Investing in this IPO could prove beneficial as the electronics market continues to expand in India, offering opportunities for substantial returns.