Gensol Engineering Share Price: Recent Trends and Analysis

Introduction

Gensol Engineering, a notable player in the Indian engineering sector, has been in the spotlight recently as its share price experiences notable fluctuations. Understanding the dynamics of Gensol Engineering’s share price is crucial for investors and stakeholders as it reflects the company’s financial health and market position. This article delves into recent developments surrounding the company’s stock performance and provides key insights for potential investors.

Recent Share Price Movement

As of late October 2023, Gensol Engineering’s share price has seen considerable changes, primarily influenced by market trends, investor sentiment, and the company’s quarterly performance reports. Following a promising earnings report in September 2023, where the company reported a 15% year-on-year increase in revenue, the share price experienced a rise. It briefly peaked at ₹350 per share, but in the following weeks, due to market corrections and the impact of global economic factors, the price has consolidated around ₹320 per share.

Market Analysis

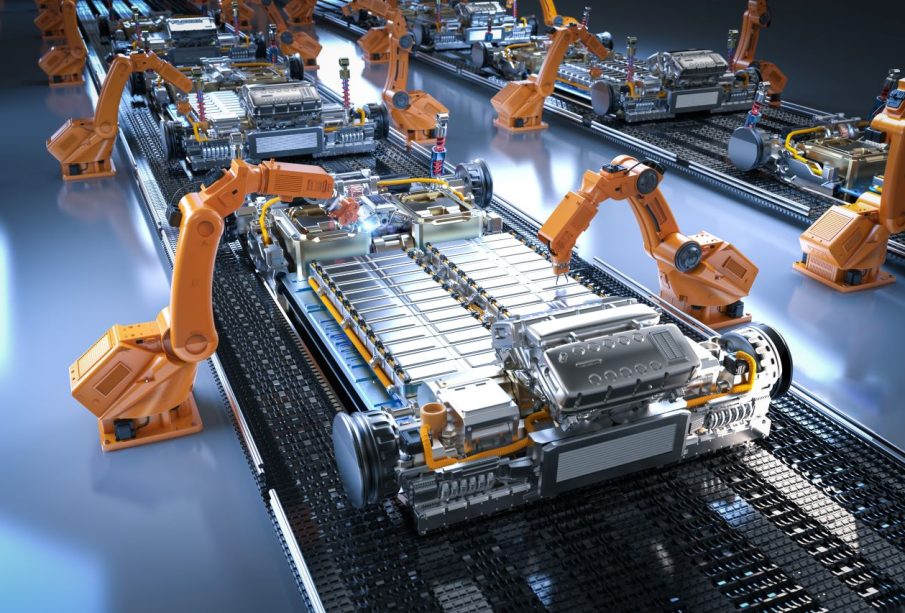

Analysts suggest that Gensol’s share price is sensitive to the broader engineering and manufacturing sector’s performance, as well as the ongoing trends in renewable energy, where the company has substantial investments. With the Indian government’s push for green energy, Gensol’s efforts to expand its renewable energy footprint could play a significant role in determining its market position.

Investor Sentiment

The sentiment among investors remains cautiously optimistic, with many analysts recommending a ‘buy’ for long-term gains, especially as the country moves towards sustainable energy solutions. However, the volatility seen in the last quarter raises concerns for short-term traders.

Conclusion

In conclusion, Gensol Engineering’s share price reflects both the company’s operational success and the prevailing market conditions. The stock is closely watched, and while analysts indicate potential for growth in the long term, they also advise caution in the short-term due to market volatility. Investors in Gensol Engineering should consider these factors and monitor ongoing developments to make informed decisions. The outlook remains positive, especially with initiatives promoting green technology, positioning Gensol well in a competitive landscape.