Federal Bank Share Price Trends: Recent Developments

Introduction

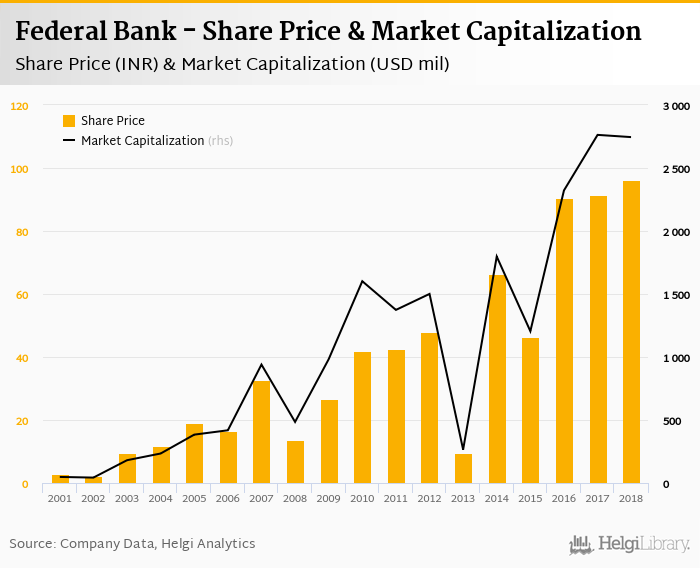

In recent weeks, the Federal Bank share price has garnered significant attention from investors and analysts alike. Understanding its trend is crucial for stakeholders seeking to capitalize on market movements. Federal Bank, one of the leading private sector banks in India, plays a pivotal role in the financial sector, and fluctuations in its stock price often reflect broader economic sentiments.

Current Trends

As of October 2023, Federal Bank’s share price has experienced a notable increase, rising by approximately 8% since September. This growth comes after the bank announced impressive quarterly earnings that surpassed analysts’ expectations. The bank reported a net profit of INR 600 crores for the second quarter, a year-on-year increase of 25%. These strong results have instilled confidence among investors, leading to increased buying activity.

Factors Influencing Share Price

Several factors have contributed to the recent rise in Federal Bank’s share price. The bank’s strategic initiatives, such as advancing its digital banking transformation and expanding its retail loan portfolio, have proven successful. Moreover, positive macroeconomic indicators, including lower inflation rates and an uptick in consumer spending, have created a favorable environment for banks.

Additionally, analysts suggest that the introduction of new banking technologies and a commitment to environmental, social, and governance (ESG) practices have further boosted investor trust in Federal Bank’s long-term prospects.

Market Outlook

The consensus among financial experts is cautiously optimistic. According to reports from major financial institutions, Federal Bank’s share price is projected to continue its upward momentum, potentially reaching INR 120 within the next quarter. However, analysts also advise maintaining vigilance in light of global economic uncertainties that could impact investor sentiment.

Conclusion

The fluctuations of the Federal Bank share price underscore the dynamic nature of financial markets. Stakeholders should remain informed about the ongoing developments within the bank and the broader economic context. As market conditions evolve, both investors and traders can benefit by keeping a close watch on Federal Bank’s performance and strategic direction, as it may offer significant opportunities for growth in the future.