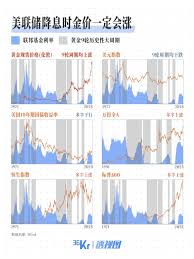

Fed Rate Cut: A Closer Look at Its Impact on Gold Prices

Introduction

The relationship between the Federal Reserve’s monetary policy decisions and gold prices has long been a focal point for investors and economists. As we see fluctuations in interest rates, particularly rate cuts, understanding their impact on gold prices becomes increasingly significant. Gold is often viewed as a hedge against inflation and economic uncertainty, thus, rate cuts can potentially affect its demand and value.

Recent Developments

In late September 2023, the Federal Reserve announced a rate cut of 25 basis points in response to slowing inflation and economic growth. This move has sparked a renewed interest in gold as a safe-haven asset. Historically, gold prices tend to rise when interest rates fall, as lower rates make gold more attractive compared to interest-bearing securities.

Post-announcement, gold prices rallied, reaching a new high of $2,050 per ounce by early October 2023. Analysts attribute this surge to the increasing demand from investors seeking safety amid economic uncertainty and geopolitical tensions.

Market Reactions

Investors have reacted positively to the Fed’s decision, leading to a spike in investments in gold exchange-traded funds (ETFs). In the past month, gold ETFs have reported inflows exceeding $1 billion, showcasing a clear trend of reallocating funds toward gold as a protective measure. Retail gold purchases have also increased, with jewelers reporting robust sales as consumers look to secure their wealth against potential inflation.

Conclusion

The recent Fed rate cut has clearly influenced the dynamics of gold prices, propelling them to new heights as investors flock to gold for security. Analysts predict that if the Fed maintains a dovish stance, we could see continued upward pressure on gold prices. However, shifts in global economic conditions and potential Fed policy changes remain critical factors to monitor. For individuals and institutional investors alike, the strategy of incorporating gold into their portfolios is likely to gain more traction in the forthcoming months as they navigate the uncertainties ahead.