Fairfax Financial’s Strategic Offer for IDBI Bank

Introduction

The recent announcement of Fairfax Financial Holdings’ offer for IDBI Bank holds substantial importance in the Indian banking sector. This development not only illustrates the growing interest of foreign investors in Indian banks but also signifies a potential shift in the ownership landscape, with implications for stakeholders and the market at large.

Details of the Offer

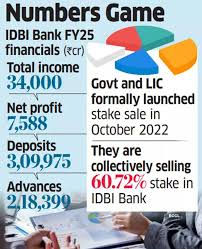

Fairfax Financial, a Canadian investment firm led by Prem Watsa, has proposed a buyout strategy for IDBI Bank, one of India’s major public sector banks. The firm intends to acquire a significant stake, aligning with its objective to solidify its presence in the Indian financial market. Reports suggest that Fairfax has expressed its interest in purchasing a large block of shares, potentially as high as 51%, which could lead to a complete takeover.

The move comes at a time when IDBI Bank has been striving to enhance its financial performance and reduce the burden of non-performing assets (NPAs). The bank has made significant progress in recent years, with a marked improvement in its financial health, making it an attractive target for investment.

Reactions and Implications

The offer has garnered mixed reactions from market analysts and stakeholders. On one hand, some experts see this as a positive development, suggesting that Fairfax’s involvement could lead to better management practices and improved operational efficiency at IDBI Bank. On the other hand, there are concerns regarding the potential impact on employees and the bank’s existing customer base during the transition phase.

The potential investment could also boost investor confidence in the banking sector, particularly in public sector banks, which have faced scrutiny regarding governance and operational mishaps over the past few years. Furthermore, Fairfax’s entry into IDBI Bank may pave the way for other foreign investments in Indian banking institutions.

Conclusion

In summary, Fairfax Financial’s offer for IDBI Bank underscores the evolving dynamics in India’s financial sector, marked by increasing foreign investment interest. As the proposal moves forward, stakeholders will be keenly observing the developments and their implications for the bank and the broader market. The outcome could reshape investor perceptions of public sector banks, enhancing their attractiveness for potential global investors.