Exploring the KFintech IPO: A Major Market Event

Introduction

The KFintech IPO, which has recently come under the spotlight, represents a significant milestone in the Indian financial services sector. As the company gears up for its initial public offering, it has gained considerable attention from both investors and analysts alike. With the growing importance of technology in finance, KFintech’s entry into the public market is indicative of the increasing trend towards tech-driven financial solutions.

About KFintech

KFintech, a leading provider of technology solutions and services for the financial services industry, has established a strong presence over the years. The company specializes in offering services that range from mutual fund solutions to pension fund administration, effectively catering to the needs of varied clients, including asset management companies and corporate treasuries. With a client base that includes major financial institutions, KFintech has positioned itself as a one-stop solution for fintech services.

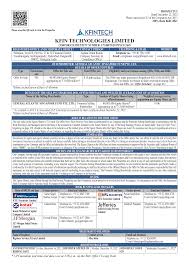

Details of the IPO

As per the latest reports, KFintech has announced plans for its IPO with a total issue size of approximately ₹1,500 crores. This includes a fresh issue of shares worth ₹800 crores and an offer for sale of shares worth ₹700 crores. The price band for the IPO is expected to be announced soon, with the company tentatively looking to launch the issue in the upcoming quarter. Market analysts believe that the IPO could attract significant interest, considering the solid track record of KFintech and the ongoing digital transformation in the financial sector.

Investor Sentiment and Market Outlook

The market sentiment surrounding the KFintech IPO is largely optimistic. Investors are showing an appetite for technology-driven listings, particularly those that showcase robust business models and growth potential. Analysts forecast that the IPO could see a substantial response from retail investors and institutional players, particularly in a time when the Indian equity markets are experiencing a healthy rebound. Financial experts recommend that potential investors keep an eye on the company’s financial health metrics leading up to the offering, including revenue growth and profit margins.

Conclusion

In conclusion, the KFintech IPO presents a compelling opportunity for investors looking to diversify their portfolios with innovative financial technology services. As the company moves closer to its public debut, the broader implications of its successful entry into the market could be far-reaching for the fintech landscape in India. Investors are advised to conduct thorough research and assess market conditions as KFintech sets the stage for what could be one of the year’s notable offerings.