Exploring the DAX Index: Germany’s Leading Stock Market Benchmark

Introduction

The DAX Index, officially known as the Deutscher Aktienindex, is a crucial indicator of the performance of Germany’s 40 largest and most liquid companies listed on the Frankfurt Stock Exchange. It serves as a barometer of the health of the German economy and is an essential tool for investors globally. Understanding the implications of the DAX Index can guide investment decisions, making it a vital topic of discussion in today’s financial landscape.

Current Events and Performance

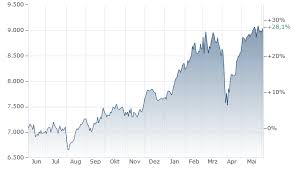

As of October 2023, the DAX Index has shown significant resilience in the face of global economic challenges. The ongoing recovery from the pandemic, coupled with increased consumer spending and a rebound in manufacturing, has positively influenced the index’s performance. Recent data reported that the DAX hit a record high of over 16,500 points in mid-October, driven largely by strong results from key sectors, including technology and automotive.

Major companies like Siemens, BMW, and SAP have all reported quarterly results that exceeded analysts’ expectations, contributing positively to the index. Additionally, the German government’s recent stimulus measures aimed at boosting economic growth have also played a part in the DAX’s favorable trajectory.

Factors Influencing the DAX Index

Several factors impact the DAX Index, including political stability, economic data releases, and global market trends. For instance, inflation rates in the Eurozone, interest rate decisions by the European Central Bank (ECB), and international trade relations, especially concerning China and the United States, significantly impact investor sentiment.

The DAX is heavily weighted towards sectors like automobiles and finance, making it sensitive to changes in consumer demand and financial market conditions. Investors are keenly watching for signals from the ECB regarding interest rate hikes, which could influence market dynamics in the coming months.

Conclusion

In summary, the DAX Index remains a vital financial indicator reflecting the performance and expectations of the German and broader European economies. Its current position and future trajectory will be critical for investors and stakeholders alike. As the global economy continues to evolve post-pandemic, the DAX Index will likely remain in focus, providing insights into market optimism or caution. Given the indicators and economic trends, many analysts predict a cautiously optimistic outlook for the index, provided that external economic variables align favorably. Investors should stay informed about developments related to the DAX Index, as it serves as a key signal for potential investment opportunities in the European market.