DMart Share Price: Latest Trends and Insights

Introduction

DMart, or Avenue Supermarts Ltd., is one of India’s leading retail chains, known for its discounted grocery and household items. The company went public in 2017, and since then, it has become a crucial player in the Indian retail sector. Understanding the DMart share price is essential for investors as it reflects not only the company’s performance but also the broader economic trends in India’s retail market.

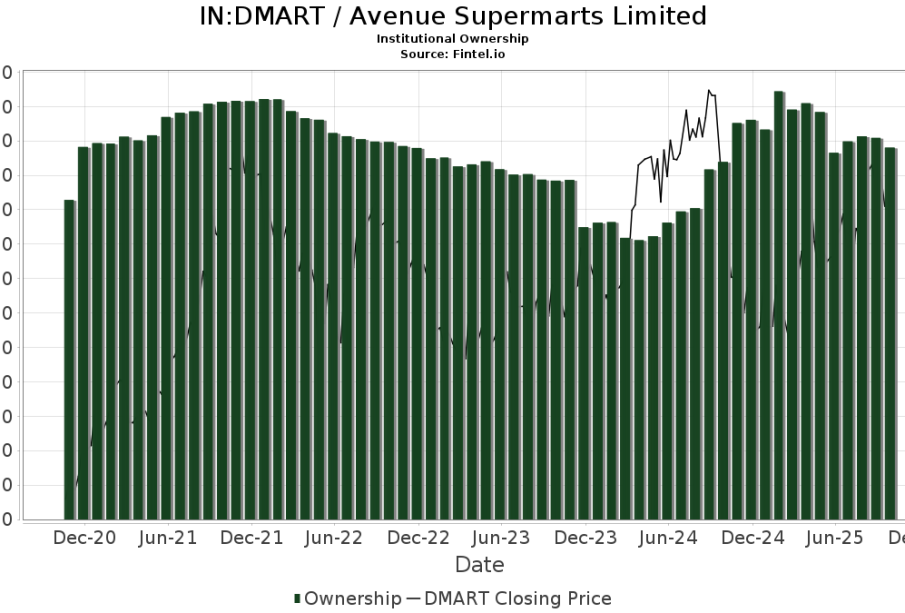

Current Share Price Trends

As of late October 2023, the DMart share price is hovering around INR 600-620 per share, demonstrating stability amid fluctuating market conditions. The shares have experienced a moderate increase of approximately 5% over the last month, supported by strong quarterly earnings and expansion plans. Analysts attribute this growth to DMart’s successful strategies in supply chain management and increasing customer base.

Factors Influencing the Share Price

Several factors drive the DMart share price. Firstly, the company’s robust financial performance has been impressive, with a consistent rise in revenues and profits. In its latest quarterly report, DMart reported a 15% increase in revenue year-on-year, which has significantly bolstered investor confidence.

Additionally, DMart’s expansion strategy plays a vital role in its share price dynamics. The company plans to open over 30 new stores across different regions in India by the end of the financial year. This aggressive growth plan not only aims to capture a larger market share but also ensures steady revenue influx in the longer term.

Market Sentiment and Analyst Predictions

The market sentiment surrounding DMart shares remains positive. Financial analysts forecast that, if the current growth momentum continues, the share price could reach between INR 700 to INR 750 within the next 6-12 months. Furthermore, DMart’s focus on enhancing digital services and promoting online sales is expected to provide additional support to its share performance.

Conclusion

In conclusion, DMart’s share price reflects its strong operational performance and positive market sentiment. With ongoing expansions and a robust financial strategy, the stock appears to be a promising investment. Investors should remain vigilant and consider the market trends and company updates while making investment decisions in this retail giant.