Dmart Share Price: Latest Trends and Insights

Introduction

The share price of Dmart, a leading player in India’s retail sector, has gained significant attention from investors and market analysts alike. As one of the largest supermarket chains in India, Dmart’s performance, particularly its stock price, reflects broader economic trends and consumer behavior in the country. Understanding the fluctuations in Dmart’s share price is crucial for potential investors looking to capitalize on the growth of the organized retail market in India.

Current Performance

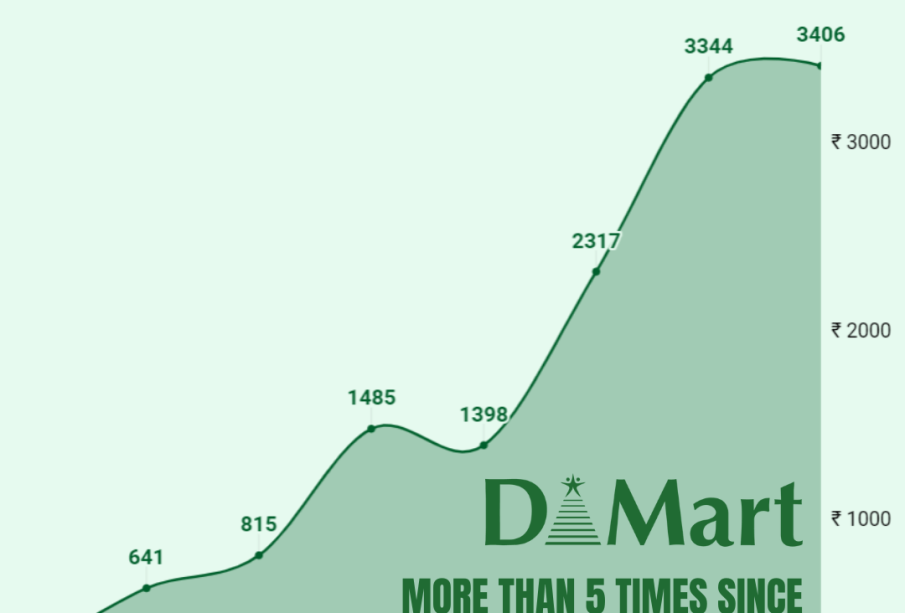

As of October 2023, Dmart’s share price has experienced a notable increase, reaching approximately INR 4,300 per share, reflecting a year-on-year growth of about 15%. The company’s robust growth trajectory can be attributed to its efficient supply chain, expanding store network, and stability in operations even amidst fluctuating market conditions. Furthermore, the recent quarterly earnings report exceeded analysts’ expectations, showing a substantial increase in revenue, which has further bolstered investor confidence.

Factors Influencing Dmart Share Price

Several factors contribute to the fluctuations in Dmart’s share price:

- Expansion Strategy: Dmart’s aggressive expansion plan is a key driver. The company aims to open new stores across urban and semi-urban areas, which will likely enhance its market share.

- Consumer Spending: The revival of consumer spending post-pandemic has played a critical role in driving sales. As disposable incomes rise and more consumers opt for centralized shopping experiences, Dmart stands to benefit significantly.

- Competition: Increased competition from other retail giants and online platforms poses a challenge. However, Dmart’s unique value proposition of providing quality products at low prices has helped maintain its loyal customer base.

Market Outlook

Analysts project a positive outlook for Dmart’s share price in the near future, with several brokerage firms recommending ‘buy’ ratings. The expected increase in earnings and stable demand from consumers is likely to keep the momentum going. However, potential investors should closely monitor market trends and economic indicators to make informed decisions.

Conclusion

The Dmart share price presents an interesting opportunity for investors looking to tap into India’s growing retail market. Its recent performance, backed by strong fundamentals and expansion plans, indicates a promising future. As always, potential investors should undertake thorough research and consider market conditions before making investment decisions. With the organized retail sector expected to grow, Dmart is well-positioned to capitalize on this trend.