DMart Share Price: Current Trends and Market Insights

Introduction

The share price of DMart, a leading retail chain in India, has become an important topic for investors and market analysts. As the company continues to expand its footprint across the nation, fluctuations in its stock price reflect not only the company’s performance but also broader economic indicators. Understanding DMart’s share price trends helps investors make informed decisions in a competitive market.

Recent Performance

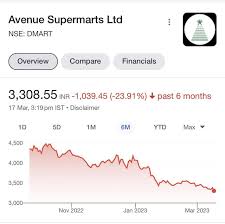

As of late October 2023, DMart’s shares have experienced notable volatility. After reaching an all-time high of ₹5,000 in early 2023, increased competition and economic challenges posed by inflation have prompted fluctuations in its share price. Currently, DMart shares are trading around ₹4,200. Analysts attribute this decline to a combination of factors, including rising input costs and consumer spending patterns shifting post-pandemic.

Market Influences

Several external factors are influencing DMart’s share price. The retail sector in India is witnessing tremendous growth, projected to reach ₹2 trillion by 2025, yet challenges such as supply chain disruptions and intensified competition from e-commerce giants like Amazon and Flipkart are impacting traditional retail players. DMart has been focusing on expansion and enhancing its online presence and affordability to counter these challenges.

Senior Analyst Insights

Market experts suggest that while the short-term outlook may appear challenging for DMart, the long-term growth trajectory remains promising. Senior analyst Meera Bansal from Acumen Securities mentioned, “Despite current challenges, DMart’s robust business model and customer loyalty can help stabilize its share price in the long run. Investors should keep an eye on their quarterly reports for indicators of recovery.”

Conclusion

Investors must remain vigilant about DMart’s share price as it interacts with broader economic conditions. With the company continuing to innovate and adapt to evolving consumer demands, the outlook for DMart can remain optimistic. Stakeholders should watch for upcoming quarterly earnings reports that may shed light on future performance. In the ever-shifting landscape of Indian retail, DMart’s resilience may reinforce its position as a strong investment opportunity.