DLF Share Price: Current Trends and Market Analysis

Introduction

The DLF share price has become a focal point for investors and financial analysts, especially considering the company’s pivotal role in the Indian real estate market. As one of the largest commercial and residential developers in India, DLF Ltd. has significant influence over market sentiments. The share price not only reflects the company’s financial health but also serves as a barometer for the real estate sector’s performance in the country.

Current Market Overview

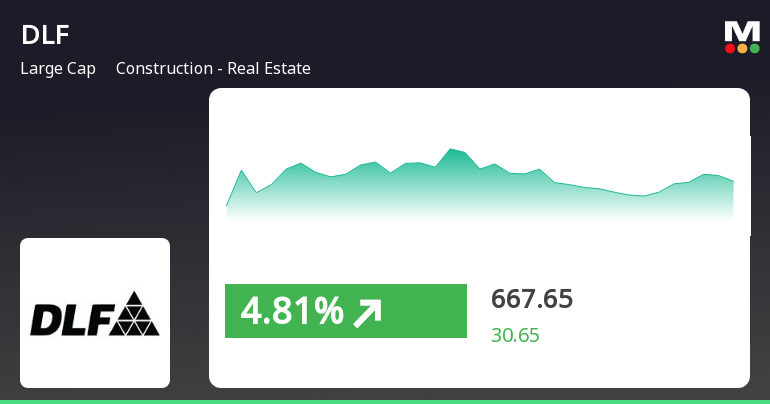

As of late October 2023, the DLF share price stood at approximately ₹450, showing a steady increase of over 5% in the past month. This surge is attributed to a series of positive developments within the company, including the successful launch of new residential projects and a strong demand for commercial spaces in metropolitan areas. Analysts are optimistic, citing factors such as increased infrastructure spending and government initiatives aimed at boosting the housing sector.

Recent Developments

Recently, DLF announced its quarterly results, revealing a net profit increase of 20% year-on-year, driven by robust sales and improved operational efficiency. In addition, the company has been proactive in addressing market needs, launching several new projects in the Delhi-NCR region, which has seen a resurgence in real estate activity.

Furthermore, the increase in interest from foreign investors and the recovery in the commercial property sector post-pandemic have positively impacted investor sentiment regarding DLF shares. Reports suggest that the demand for premium housing has also increased, leading to a higher sales rate and subsequently, a better outlook for the company.

Analyst Sentiment

Experts predict that the DLF share price may continue to trend upwards, with many investment analysts suggesting ‘buy’ ratings for DLF shares at present levels. The anticipated sales from upcoming projects and strategic infrastructure developments, such as the Delhi-Mumbai Expressway, are expected to provide further support for price increases. However, analysts also caution potential investors about market volatility and economic uncertainties, encouraging diligent analysis before investment.

Conclusion

The DLF share price remains a significant point of interest in the Indian stock market, reflecting broader trends in real estate and investor confidence. As the company continues to adapt and grow in a recovering market, potential investors may find opportunities. It is crucial, however, to keep an eye on market trends, economic indicators, and DLF’s strategic decisions in the coming months.