Current Updates on NALCO Share Price

Introduction

The share price of National Aluminium Company Limited (NALCO) has been a focus for investors, analysts, and market watchers, given its significant role in India’s aluminium production and strategic importance in various industrial sectors. Understanding NALCO’s share price fluctuations is essential for making informed investment decisions, especially as global commodity prices and domestic industrial demands continue to evolve.

Current Market Performance

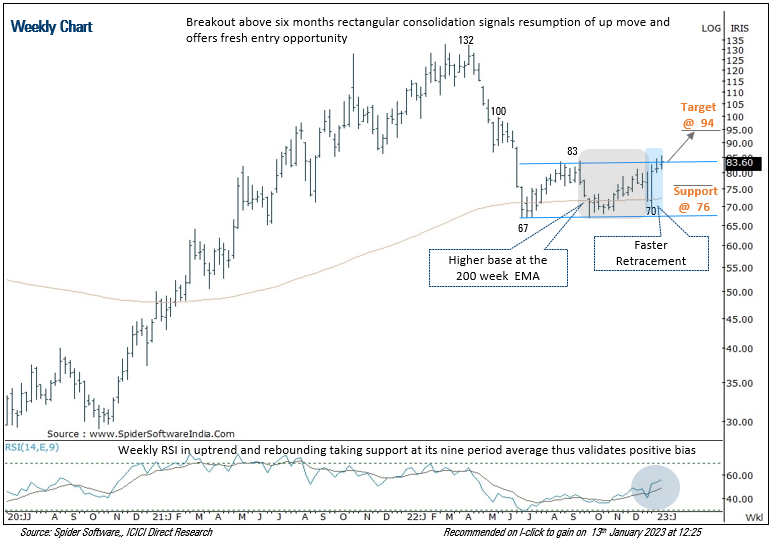

As of October 2023, NALCO’s share price has exhibited increased volatility amid global market dynamics. The stock is currently trading at approximately INR 75, reflecting a recent gain of 5% over the past month. Analysts attribute this uptick to the rising demand for aluminium component sectors and favorable government policies aimed at boosting domestic manufacturing. In comparison, the broader market, as indicated by the Nifty 50, is up by around 2% in the same period.

Factors Influencing NALCO’s Share Price

Several factors have contributed to the recent fluctuations in NALCO’s share price:

- Global Aluminium Prices: The price of aluminium in global markets has shown resilience in 2023, driven by rebounding demand in the automotive and construction sectors.

- Government Policies: The Indian government’s initiatives to boost domestic manufacturing and reduce imports have positively influenced investor sentiment towards NALCO.

- Quarterly Earnings Reports: NALCO’s recent quarterly earnings, which showed a robust growth in profits, have further fueled investor interest and support for the stock.

Future Outlook

Looking ahead, market experts anticipate that NALCO’s share price may continue to experience fluctuations, particularly with upcoming quarterly results and developments in the global aluminium market. If demand remains strong and operational efficiencies improve, analysts project that NALCO’s share price could rise further, potentially reaching the INR 85 mark by the end of the year. However, investors are encouraged to remain vigilant and consider market volatility and external economic factors influencing commodity prices.

Conclusion

Understanding NALCO’s share price dynamics is crucial for investors who are looking to capitalize on potential growth opportunities in the aluminium sector. With the interplay of various market factors, NALCO represents a strategic investment option in the evolving landscape of India’s manufacturing and industrial growth.