Current Update on Reliance Infra Share Price

Introduction

The share price of Reliance Infrastructure (Reliance Infra) has gained significant attention in recent weeks due to fluctuations influenced by broader market trends and company-specific developments. Understanding the dynamics of Reliance Infra’s share price is crucial for investors and market watchers, especially in the context of India’s rapidly evolving infrastructure sector.

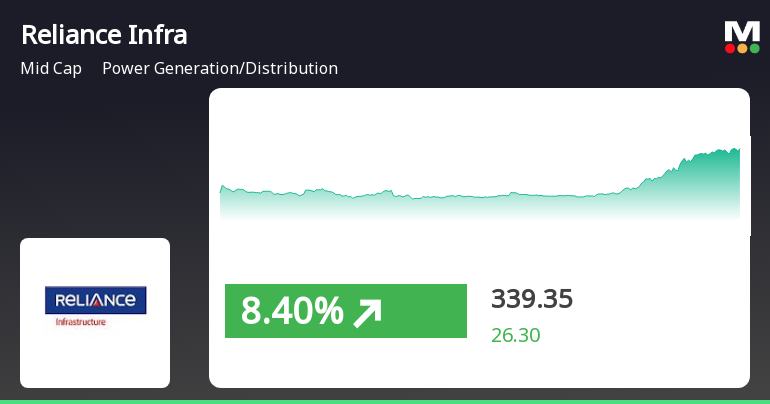

Recent Trends in Share Price

As of October 2023, Reliance Infra’s share price has shown considerable volatility. Trading around ₹80 per share at the beginning of October, the stock experienced a peak of ₹92, reflecting a rise attributed to positive news surrounding infrastructure projects and government spending on urban development.

However, analysts noted a correction following this peak, with the price retracting to around ₹85, primarily due to profit-booking by investors. This reflects a typical trend in the stock market where quick gains prompt investors to capitalize on profits, leading to short-term price corrections.

Factors Influencing Share Price

Several specific factors have influenced Reliance Infra’s share price in recent months. Firstly, government initiatives to boost infrastructure spending have increased optimism about the company’s potential projects, which could enhance revenue streams. The company’s diversification into renewable energy and its partnerships for upcoming projects have also generated a positive sentiment among investors.

On the other hand, the share price has been susceptible to external economic indicators including inflation rates, global oil prices, and macroeconomic stability. Recent fluctuations in these parameters have introduced uncertainty among investors, contributing to the share’s volatility.

Market Analyst Opinions

Market analysts have mixed opinions regarding the future of Reliance Infra’s share price. Some suggest a bullish outlook, predicting potential price increases due to ongoing government projects and expansions in the renewable sector. Others advise caution, pointing out that geopolitical tensions and fluctuations in global markets could hinder growth aspects.

Conclusion

In summary, the Reliance Infra share price reflects a complex interplay of market dynamics influenced by both internal and external factors. For investors, keeping a close watch on market trends, regulatory changes, and company announcements will be key to making informed decisions. Forecasts suggest that while potential for growth exists, volatility is likely to remain a constant feature in the near term. An informed approach could help investors navigate through the fluctuations in reliance infra share price successfully.