Current Trends in Wockhardt Share Price

Introduction

Wockhardt Limited is one of India’s leading pharmaceutical and biotechnology companies, well-known for its contributions to the healthcare sector. The company operates both domestically and internationally, making it a prominent player in the stock market. Understanding the Wockhardt share price is crucial for investors as it reflects the company’s performance, market trends, and economic conditions.

Recent Performance

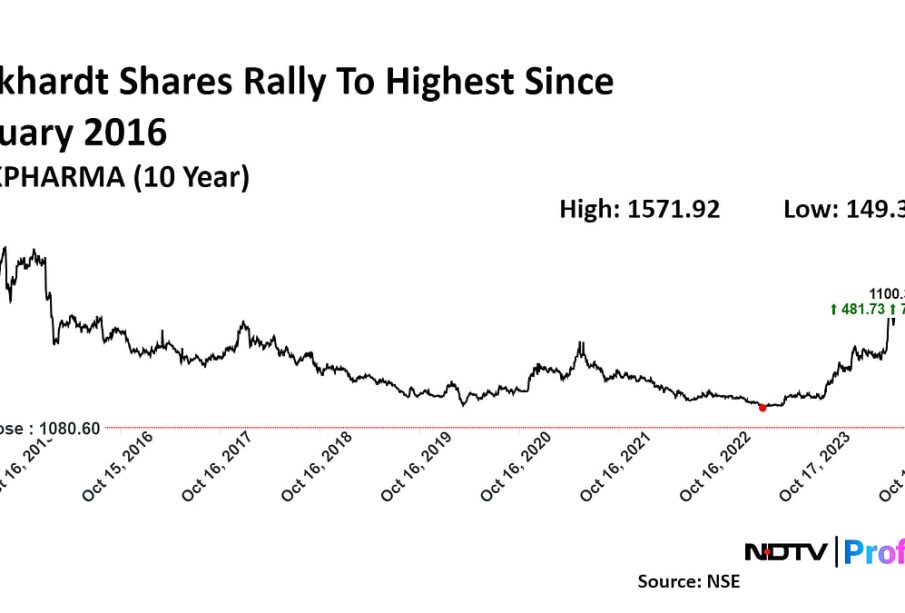

As of October 2023, Wockhardt shares have shown significant volatility influenced by various factors, including financial performance reports, market sentiment, and global economic conditions. The share price recently saw a peak at INR 1,020, following the company’s announcement of successful trials for a new drug, which has the potential to expand its revenue streams considerably.

However, the stock also faced downward pressure due to external market factors, including fluctuations in raw material costs and regulatory concerns surrounding pharmaceutical pricing. Analysts have been closely monitoring these trends, as they play a pivotal role in shaping investor confidence.

Market Influence and Predictions

Several factors are contributing to the current trends in Wockhardt’s share price. Firstly, the global demand for pharmaceuticals and the increasing focus on biotechnology are generally bullish for companies like Wockhardt. Furthermore, the recent expansion of their manufacturing capacity is expected to yield positive results.

Market experts predict that if the company succeeds in maintaining its innovation pipeline and effectively navigating regulatory challenges, the share price could experience a sustainable upward trend in the coming quarters. Analyst ratings suggest a cautious optimism, with a consensus price target of around INR 1,200 by mid-2024, assuming continued positive developments.

Conclusion

Understanding the dynamics behind Wockhardt’s share price is essential for potential investors. With a mix of favorable growth opportunities coupled with certain risks, the stock presents a complex but potentially rewarding investment proposition. Followers of the pharmaceutical sector should remain informed about company announcements and market conditions to gauge the best investment strategy moving forward.