Current Trends in Wockhardt Share Price

Introduction

Wockhardt Ltd., a prominent pharmaceutical and biotechnology company based in India, has been making headlines with its fluctuating share prices. Understanding share price movements is crucial for investors and stakeholders as it reflects the company’s performance, market perceptions, and future potential. The relevance of Wockhardt’s share price lies in its implications for both short-term traders and long-term investors looking to evaluate their portfolio strategies.

Recent Events Impacting Share Price

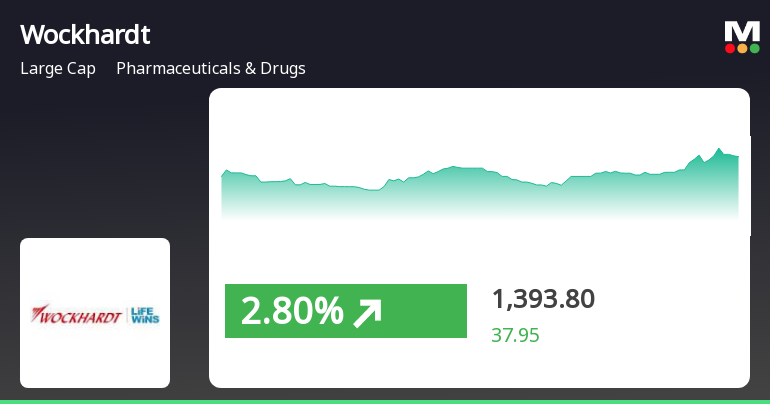

As of October 2023, Wockhardt’s share price has seen significant volatility due to various factors. Analysts attribute recent dips and surges to changes in global market conditions, regulatory updates, and quarterly earnings reports. For instance, in its latest earnings report, Wockhardt reported a revenue growth of 15% year-on-year, largely driven by its vaccine and biotechnology segments, which have gained traction in the international market.

Furthermore, pending approvals for new drug formulations in the US and EU also play a role in influencing investor sentiment. In light of these developments, Wockhardt’s share price had a recent peak of ₹740, reflecting a bullish trend among investors excited about the company’s growth prospects. However, fluctuations in raw material prices and the ongoing challenges of the pandemic continue to weigh on the market performance.

Market Analysts’ Perspectives

Market analysts are divided in their projections for Wockhardt’s share price. Some assert that the company is on a growth trajectory given its strong product pipeline and strategic investments in research and development. They predict a target price of approximately ₹800 in the next quarter if the company maintains its current growth rate. Conversely, other analysts caution about potential risks, such as regulatory hurdles and market competition, advising investors to tread carefully.

Conclusion

In summary, Wockhardt’s share price remains a focal point for investors seeking growth opportunities in the pharmaceutical sector. While recent developments suggest bullish momentum, it is essential to consider both the positive indicators and the potential risks. Forecasting the share price involves a careful analysis of the company’s business strategy, market conditions, and global health trends. For investors, staying informed about these factors is crucial for making sound investment decisions concerning Wockhardt’s stock.