Current Trends in Wockhardt Share Price

Introduction

The share price of Wockhardt, a prominent pharmaceutical company in India, has attracted significant attention from investors and market analysts alike. As one of the key players in the pharmaceutical and biotechnology sector, fluctuations in its stock value can have broader implications for the market. Understanding the current trends in Wockhardt’s share price helps stakeholders make informed decisions.

Recent Performance

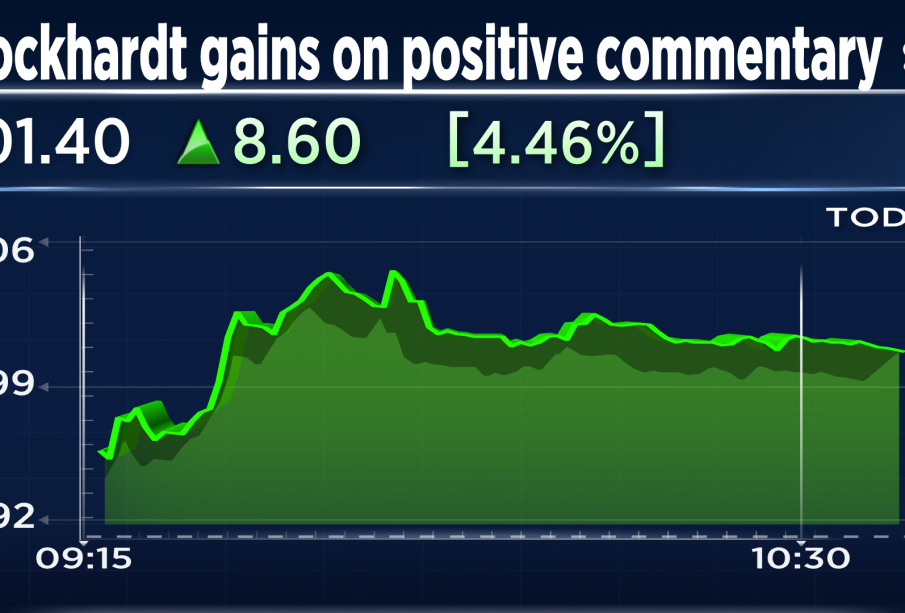

As of mid-October 2023, Wockhardt’s share price has seen noteworthy movement, currently trading at approximately ₹390 per share, marking a rise of around 5% over the past week. This uptick comes on the heels of several strategic developments within the company, including new product launches and increased exports. Analysts have also pointed out that the recent approval for one of its key drugs in international markets has provided a boost to investor confidence.

Factors Influencing Share Price

Several factors are influencing the share price of Wockhardt at this time. First, the recent quarterly earnings report showed a robust performance, with a 15% increase in revenue year-on-year. Furthermore, with the global pharmaceutical market projected to grow, Wockhardt is positioned well to capitalize on new opportunities.

Market analysts suggest that the company’s strong commitment to research and development, with significant investments heading towards innovative therapies, is a positive sign for the future. Additionally, strategic partnerships and collaborations are expected to enhance their market reach, further solidifying their foothold in both domestic and international markets.

Market Outlook

The outlook for Wockhardt’s share price remains optimistic, with analysts predicting a continued upward trend in the upcoming months as the company rolls out new products and expands its market presence. However, external factors such as regulatory changes and economic stability cannot be overlooked and may impact share valuations.

Conclusion

For investors and stakeholders in Wockhardt, staying updated about the company’s developments and stock performance is crucial. As the pharmaceutical industry continues to evolve, Wockhardt’s ability to adapt to market demands will be pivotal in sustaining and enhancing its share price. Engaging with reliable financial news sources and keeping an eye on investor sentiments can help stakeholders navigate their investment strategies more effectively.