Current Trends in Voltas Share Price: An Overview

Introduction

The Voltas Limited share price has become a focal point for investors and market analysts, reflecting not only the company’s performance but also the broader economic environment in India. As a prominent player in the air conditioning and engineering sectors, understanding the trends associated with Voltas’ share price is crucial for stakeholders and potential investors alike.

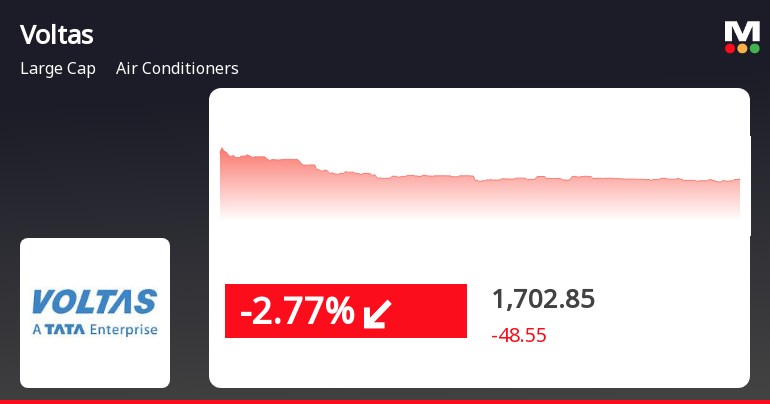

Current Market Performance

As of mid-October 2023, the share price of Voltas Limited has shown significant fluctuations. The stock is currently trading at approximately INR 970, which reflects a drop of around 5% over the past month. Analysts attribute this decline to various factors, including rising raw material costs and subdued demand in the HVAC (Heating, Ventilation, and Air Conditioning) sector.

Factors Influencing Share Price

1. Increase in Raw Material Costs: The recent surge in the prices of critical components and refrigerants has impacted profit margins, prompting concern among investors.

2. Regulatory Changes: Changes in government policies regarding energy efficiency guidelines for air conditioning units have affected market dynamics, potentially leading to shifts in consumer buying patterns.

3. Global Economic Conditions: As a company that operates on an international scale, Voltas is exposed to global market fluctuations, including currency exchange rates and commodity prices, which can influence investor sentiment.

Recent Developments

Recently, Voltas announced its quarterly earnings report, which, although slightly below analysts’ expectations, still highlighted a robust growth outlook for the coming years. The company is also expanding its product portfolio, introducing more energy-efficient models that align with the government’s green energy initiatives. This could potentially revitalize its market position and share price in the future.

Conclusion

As Voltas Limited continues to navigate through the complexities of raw material price fluctuations and changing consumer preferences, investors are urged to stay informed on market trends. Despite the current dip in share price, the company’s proactive strategy towards innovation and compliance with sustainability initiatives may bode well for its future growth. Analysts suggest that maintaining a watchful eye on economic indicators and company announcements will be crucial for deriving potential investment opportunities.