Current Trends in Vodafone Idea Share Price

Introduction

Vodafone Idea’s share price has been a significant topic of discussion among investors and market analysts in India, especially given the intense competition in the telecom sector and the company’s struggle for profitability. As one of the leading telecom operators, its performance directly impacts market sentiment and investment decisions.

Recent Trends and Performance

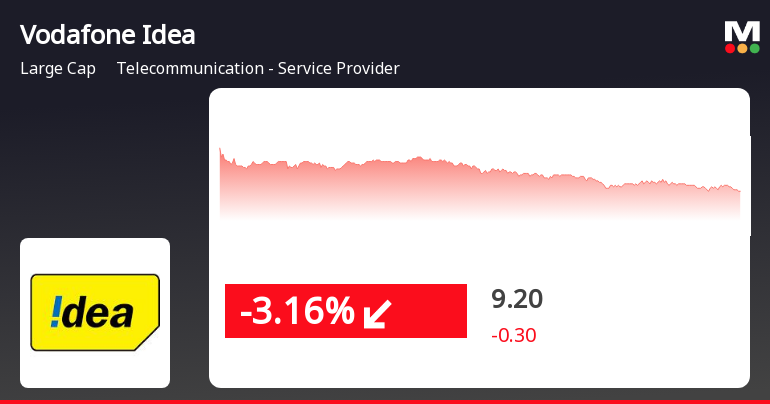

As of late October 2023, Vodafone Idea’s shares have shown signs of volatility, trading at around ₹8.60. This value reflects a slight uptick from the significant lows previously experienced throughout the year, driven mainly by the company’s restructuring efforts and cost-cutting measures. Investors are reacting to the telecom operator’s significant debt burden, amounting to over ₹1.8 lakh crores, leading to cautious optimism regarding its share performance.

The company’s initiatives to enhance network infrastructure and improve customer service aim to regain market share that has historically been lost to competitors like Reliance Jio and Airtel. Recent reports indicate a gradual increase in subscriber base, primarily driven by promotional offers and network expansion in rural areas, which could positively influence future stock performance.

Market Analysis

Analysts remain divided on the outlook of Vodafone Idea’s share price. Some experts believe that if the company successfully implements its strategies to reduce debt and improve profitability, it could present an attractive investment opportunity. Conversely, others caution that economic headwinds and intense competition may hinder recovery efforts in the near term.

Importantly, the regulatory decisions, particularly those affecting pricing and tariffs, are likely to be crucial in determining Vodafone Idea’s future performance. The company’s focus on increasing Average Revenue Per User (ARPU) is another critical factor that investors are monitoring closely.

Conclusion

In conclusion, Vodafone Idea’s share price remains a focal point for investors influenced by broader market conditions, competitive pressures, and company strategies. The potential for recovery exists, but significant risks must be navigated carefully. Potential investors should stay updated with the latest market analyses and corporate announcements to make informed decisions moving forward. The upcoming quarterly earnings report in November is expected to provide further insights into the company’s operational health, possibly impacting share price trends significantly.