Current Trends in Transformers and Rectifiers Share Price

Importance of Share Pricing in the Electronics Sector

The share price of companies in the electronics sector, such as Transformers and Rectifiers, is a significant indicator of market performance and investor confidence. Understanding these trends is crucial for investors and stakeholders who need to make informed decisions.

Recent Developments

As of October 2023, Transformers and Rectifiers (India) Limited (TRIL) has been displaying noteworthy changes in its share price. The company’s stock has seen fluctuations due to various factors, including shifts in market demand for electrical components, recent financial results, and economic conditions affecting the manufacturing sector.

In the latest quarter, the company reported a revenue increase of 15% year-on-year, which positively impacted investor sentiment. Analysts attribute this growth to rising orders in renewable energy projects and infrastructure developments in India. Furthermore, TRIL’s efforts to expand its product range and pursue export opportunities have also contributed positively to its outlook.

Market Sentiment and Forecast

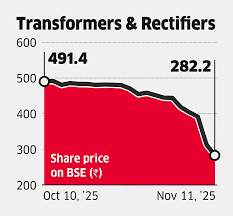

Market analysts observe that the Transformers and Rectifiers share price remains somewhat volatile, primarily due to global supply chain challenges and raw material costs. However, there is a cautious optimism based on the government’s push for electricity infrastructure improvements and sustainable energy.

Currently, the share price is hovering around INR 100 per share, with projections suggesting potential growth as demand for transformers and rectifiers for grid modernization and renewable projects increase. Investors should keep an eye on various economic indicators and company earnings reports to gauge future movements in the stock price.

Conclusion

In summary, the share price of Transformers and Rectifiers is currently influenced by several internal and external factors. As the company continues to innovate and expand in response to market demands, stakeholders should consider both the risks and opportunities present in the electronics sector. Continuous monitoring of market conditions and company performance will be essential for making savvy investment decisions moving forward.