Current Trends in Tata Steel Share Price

Introduction

Tata Steel is one of India’s leading steel manufacturing companies and plays a vital role in the country’s industrial landscape. The company’s share price is a significant indicator of its financial health and market performance, influencing investor decisions and the broader economy. Recently, fluctuations in Tata Steel’s share price have garnered significant attention due to varying factors affecting the steel industry and market sentiment.

Recent Developments

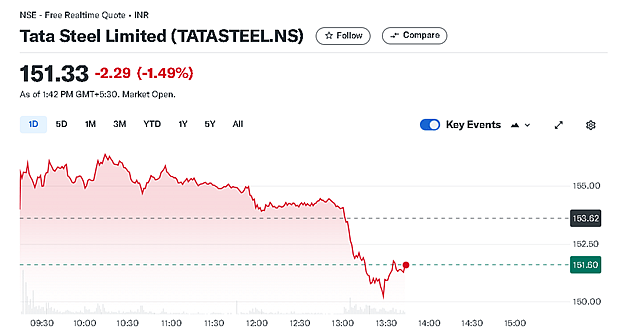

As of the latest trading session on October 15, 2023, Tata Steel shares were trading at INR 1200, experiencing a rise of 2.5% from the previous week. Analysts attribute this increase to a combination of strong quarterly earnings, a surge in demand for steel, particularly in the construction and automotive sectors, and strategic supply chain improvements implemented by the company.

In the second quarter of 2023, Tata Steel reported a net profit of INR 3,000 crore, marking a 15% increase year-on-year. This positive earnings report boosted investor confidence, contributing to the upward movement in the stock price. Additionally, global steel prices have seen a rebound following supply chain disruptions that affected production earlier in the year. Analysts believe that this trend is likely to continue, fostering a positive market outlook for Tata Steel.

Market Factors Influencing Share Price

Several factors have contributed to the recent changes in Tata Steel’s share price. One prominent reason is the increase in raw material costs, which the company has managed to navigate through efficient inventory management and pricing strategies. Moreover, Tata Steel’s initiatives towards sustainability and green steel production have captured the attention of environmentally conscious investors.

The recent government policies aimed at boosting infrastructure development have also played a crucial role. The increased allocation for infrastructure projects in the budget, which includes significant funding for highways, railways, and urban infrastructure, is expected to drive steel demand and consequently benefit Tata Steel.

Conclusion

In summary, Tata Steel’s share price is currently on an upward trajectory, bolstered by strong earnings, favorable market conditions, and the company’s strategic initiatives. Investors and market analysts remain optimistic about the future of Tata Steel, given the ongoing demand for steel in multiple sectors and the company’s responsiveness to market changes. Looking ahead, sustained focus on innovation in production techniques and expansion in key markets may further enhance shareholder value and stabilize share price movements in the future.