Current Trends in Tata Steel Share Price

Introduction

Tata Steel, one of India’s largest steel manufacturers, plays a pivotal role in the stock market. As a key player in the metal sector, its share price is often seen as a barometer of economic confidence in the industrial segment. Monitoring the fluctuations in Tata Steel’s share price is crucial for investors and analysts alike, given its impact on market dynamics and investment strategies.

Recent Trends in Tata Steel Share Price

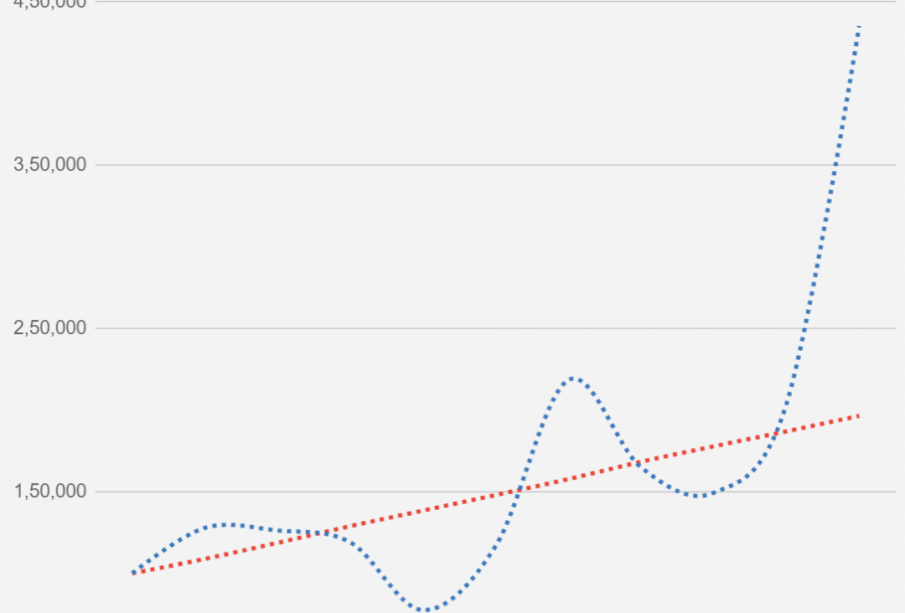

As of October 2023, Tata Steel’s share price has shown notable activity, significantly influenced by global steel demand, raw material costs, and overall market sentiment. According to the latest market reports, Tata Steel’s share price has been fluctuating between ₹1200 to ₹1300 over the past month, driven by factors such as production updates, international commodity price changes, and quarterly financial results.

Recently, Tata Steel reported a quarterly revenue growth of 15%, which positively affected its stock performance. Market analysts attribute this growth to increased infrastructure spending and demand in the automotive sector. Moreover, initiatives to enhance operational efficiency and reduce costs are expected to contribute to future growth, making Tata Steel a potential buy for investors looking at long-term gains.

External Influences on Tata Steel’s Performance

The global steel market is currently experiencing volatility, primarily due to fluctuating iron ore prices and trade tensions across major economies. Investors are keenly watching how Tata Steel adapts to these changes. In recent weeks, the company’s stock has been affected by news of increased production capacity and environmental regulations, which may impact operational costs in the long run. Furthermore, China’s steel production cuts have generated speculation about reduced competition and potentially higher prices for firms like Tata Steel.

Conclusion

In conclusion, Tata Steel’s share price remains a focal point of interest in the stock market, heavily influenced by both domestic and international market factors. For investors, keeping a close watch on ongoing developments in the steel industry, production updates, and economic indicators will be key to making informed decisions. Given the current trends and analytical predictions, Tata Steel’s stock could provide significant opportunities for those willing to navigate the inherent market risks associated with the steel sector. As the fiscal year progresses, investors should sensibly assess their positions concerning Tata Steel, as potential upside could be significant, especially with increasing manufacturing demand.