Current Trends in Tata Motors Share Price

Introduction

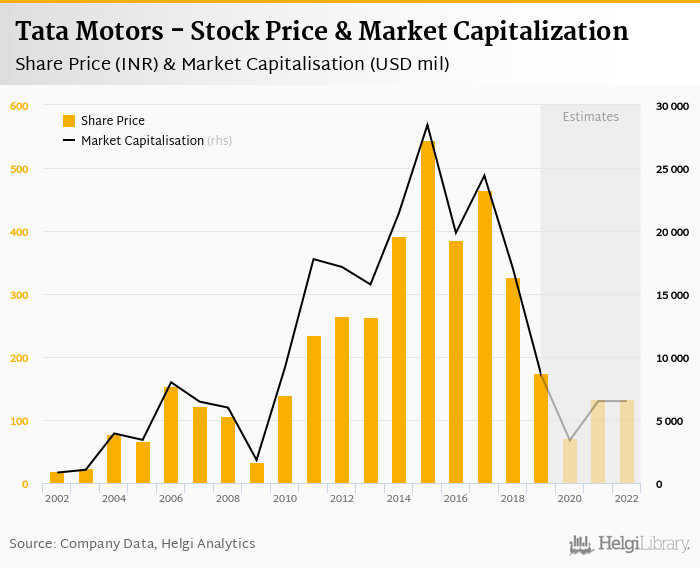

Tata Motors, one of India’s largest automotive manufacturers, has been in the spotlight recently due to fluctuations in its share price. Understanding the share price trends of Tata Motors is crucial not only for investors but also for those interested in the broader automotive sector and the Indian economy. The performance of Tata Motors shares can reflect both market sentiments and strategic decisions undertaken by the company.

Recent Trends in Tata Motors Share Price

As of mid-October 2023, Tata Motors’ share price has experienced notable volatility, closing at INR 674.50 on October 13, 2023. In the past month alone, there have been fluctuations of over 7%, reflecting investor responses to the company’s quarterly earnings report, which showed a revenue increase but also highlighted rising costs due to supply chain issues.

Market analysts have attributed some of the share price changes to broader economic indicators, including fluctuations in commodity prices and changes in sentiment about the automotive industry in light of rising electric vehicle (EV) demand. The recent announcement regarding Tata Motors’ investment in EV technology has been positively received, suggesting a strategic pivot towards sustainable solutions, which has further impacted investor interest.

Impact of Global and Local Market Dynamics

The share price of Tata Motors is also influenced by global market conditions, including the semiconductor shortage that has affected automotive production worldwide. Reports indicate that while Tata Motors has adapted better than many competitors, the ongoing supply challenges continue to place a dampening effect on stock performance.

Moreover, local factors such as government initiatives to promote green vehicles and favorable policies have also played a role in shaping market dynamics. Analysts predict that as long as the Indian government continues to support electric vehicle adoption, Tata Motors could see a more stable share performance in the upcoming quarters.

Conclusion

In conclusion, the fluctuations in Tata Motors’ share price reflect a complex interplay of internal company performance, investor sentiment, and external economic factors. For investors, keeping an eye on both company news and market trends is essential when considering potential investments in Tata Motors. With ongoing developments in the automotive space, particularly concerning electric vehicles, forecasts indicate a possibility of increased volatility but also opportunities for growth. As trends evolve, stakeholders must remain attentive to shifts that could impact the share price further.