Current Trends in South Indian Bank Share Price

Importance of Tracking Share Prices

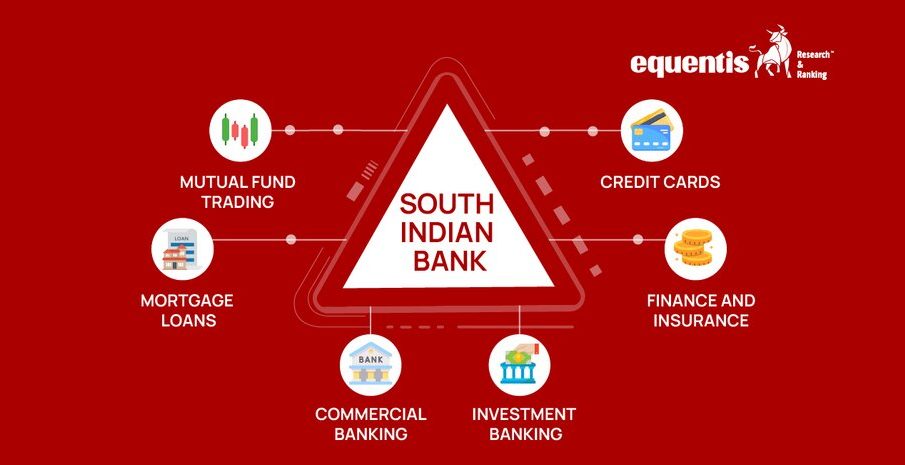

The share price of banks is a critical indicator of their financial health and market perception. Investors and analysts closely observe fluctuations to make informed decisions. South Indian Bank, a prominent private sector bank in India, has recently attracted attention due to its performance in the stock market.

Current Share Price Overview

As of the latest trading session on October 20, 2023, the share price of South Indian Bank is reported at ₹20.50, exhibiting a modest increase of 3.5% over the previous week. This upward trend is part of a broader recovery seen in the banking sector following recent policy changes by the Reserve Bank of India aimed at boosting liquidity and supporting economic growth.

Key Factors Influencing the Share Price

Several factors are influencing the current share price of South Indian Bank:

- Financial Performance: The bank released its quarterly results last month, showing a 15% increase in net profit compared to the previous year, which contributed positively to investor sentiment.

- Economic Indicators: Economic recovery post-pandemic has led to increased credit demand, favorably impacting the bank’s outlook.

- Market Trends: The banking sector is witnessing a resurgence as investor confidence grows amid improved economic conditions nationwide.

Recent Developments

In addition to financial results, South Indian Bank has been actively enhancing its digital offerings, investing in technology to improve customer experience. These strategic initiatives are expected to provide a competitive edge and potentially enhance profitability in the long run.

Forecast and Conclusion

Looking ahead, analysts forecast a cautiously optimistic outlook for South Indian Bank’s share price. If the bank continues to show strong financial results and maintains its growth trajectory, the share price could see further appreciation.

For investors, it is important to monitor not only the share price but also broader economic indicators and banking sector health, which could influence future performance.

In conclusion, staying informed about developments in South Indian Bank’s performance and external economic factors will be essential for investment decisions in the coming months.